What are the top reasons for accountants failing AML compliance investigations?

There are many reasons for accountants failing AML compliance investigations but the most common include a lack of due diligence on both new and existing clients, a lack of risk assessments, and not reviewing their processes.In this article we will look at who investigates accountants, the fines they handed out as well as the most common reasons for failing practice assurance checks.

AML compliance has been a fixture of the UK accountancy landscape for years now and will only become increasingly more important and stringent as the government continues to hold it as a priority for the private sector.

However, each year hundreds of thousands of pounds in fines for non-compliance are handed out to accountancy firms which are found to have fallen short of the required standards. It is important to note that these are not for having been linked to any money laundering or criminal activity but merely for having been found to not have the sufficient checks, processes, and recording in place.

Very few of these companies will have actively decided not to meet their compliance obligations and will have been operating under the assumption their processes were up to snuff or have been unaware that they were bound by AML regulations at all.

Accountancy as a sector suffers from a lack of understanding around its AML obligations and the various means by which their services can be exploited by criminals. This is largely due to the complexity of the rules and subject matter as well as poor communication from the government and governing bodies.

The result is accountants being among the most penalised businesses for failing to meet AML standards.

Transform your AML process with Red Flag Alert

Request a free trialRegulatory bodies and fines

Any that are used to the often vague and confusing nature of UK AML laws will not be surprised to find out that there are actually 14 governing bodies within the accountancy sector that are responsible for overseeing AML compliance. Added to this number is HMRC.

HMRC and ICAEW have by far the biggest remit, with the latter carrying out the bulk of AML practice assurance checks within the industry.

What may come as a surprise is that of the 408 fines for non-compliance given out by HMRC between April and September 2023 (the most recent figures available) over a quarter (106) were accountants; with the total value of these fines exceeding £371,000.

The ICAEW’s most recently published AML Supervision Report shows that over £218,000 in fines and two disqualifications were generated by the 1,081 practice assurance visits that they carried out.

Transform your AML process with Red Flag Alert

Request a free trialTop 5 reasons for failing an ICAEW AML compliance investigation

1. Not properly updating customer due diligence

The most common reason for non-compliance is not updating customer due diligence AML on a regular basis. For accountants this is usually every 12 months or if your client begins using a service of yours they had not previously.

Due to the nature of accountancy, relationships with clients are not through a series of one-off transactions but are on an ongoing basis, sometimes stretching decades. But just because a client was not an AML risk when they were onboarded does not mean that they will not become one. For this reason, you are obligated to periodically rerun your processes on your clients even if nothing appears to have changed.

A common cause of failure is that often accountants clear their clients through these checks on the basis that they are familiar with them and their business and ‘know’ they are not a risk. Even if this assumption is correct, which is not always the case, it does not provide the evidence required to pass AML regulations.

2. Not properly risk assessing clients

The second most common reason for failure is not performing the appropriate level of risk assessment on clients. A company’s risk assessment processes form a vital part of their AML defences. These assessments dictate to staff the level of due diligence they need to perform on an individual client and evidence to investigators that their risk has been considered in a measured and reasonable way.

Again, risk assessments are not just for onboarding and each client should be reassessed on a regular basis, usually 12 months, as part of your due diligence update.

3. No due diligence on new clients

Perhaps the worst reason for failing a practice assurance assessment is not running AML processes on clients at all. Should this be the case at your firm then you will almost certainly face a hefty fine and are opening yourself up to disciplinary action from your regulatory body.

4. Incomplete criminal checks on BOOMs

It is a requirement of the ICAEW that all BOOMs (beneficial owners, officers, and managers) must be run through a criminal check and submit a criminal record certificate proving they have no relevant unspent criminal convictions.

5. Lack of regular reviews of policies, controls, and procedures

Just as you must regularly review your clients’ AML statuses, you must regularly review the entirety of your practice’s AML processes and policies and prove that they are still appropriate measures to detect and mitigate AML risk.

This is often brushed away as something that is unimportant and that requires only a cursory review, but this is far from the case. In reality this ensures that your practice is taking the necessary steps to fight money laundering, and it also proves to regulators that your policies and processes are well thought out and appropriate.

Talk to us about your AML processes

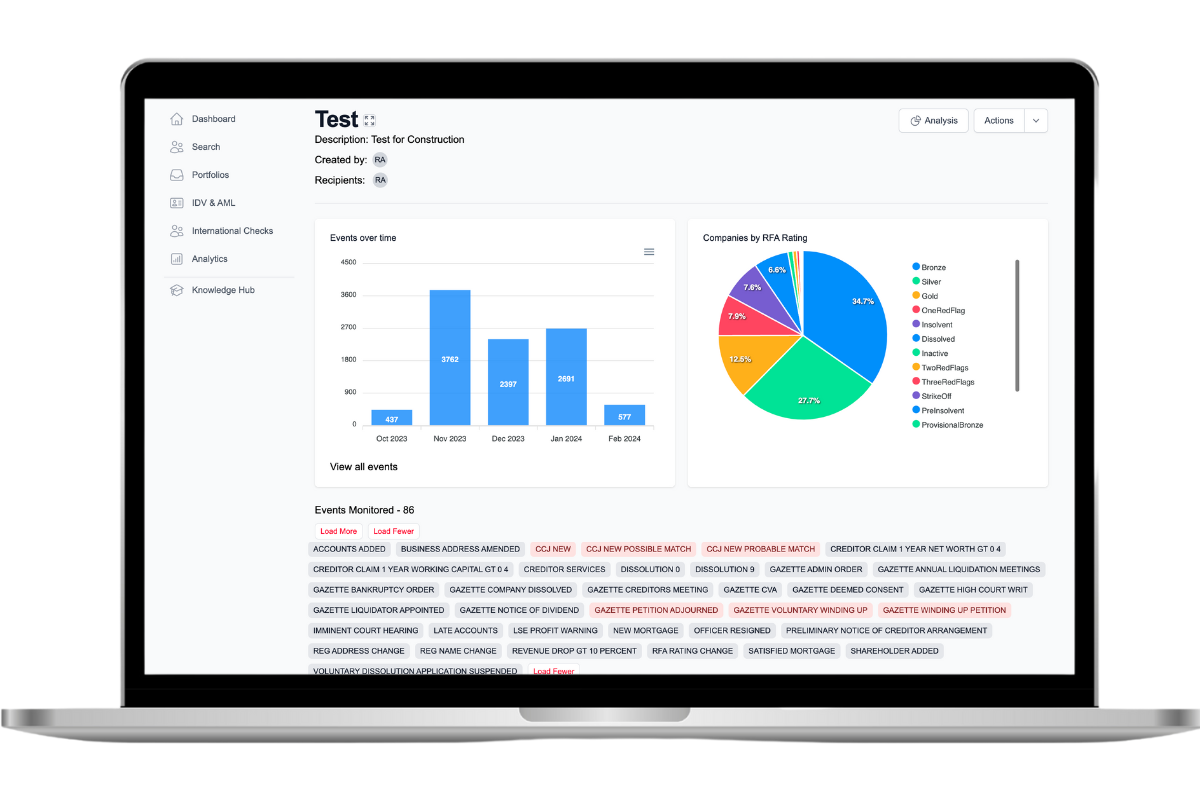

We understand the difficulties facing accountants and their AML processes and have built a fully digital AML check platform which takes the time and stress away from your AML processes.

Our fully compliant checks take just seconds to send out, are completed on your client’s device in moments, and are powered by AI technology that provides an unbeatable level of accuracy.

Speak to one of our experts about your processes and how Red Flag Alert will upgrade your processes today.

Transform your AML process with Red Flag Alert

Request a free trial