Onboarding new clients is not merely about expanding customer bases but also about adhering to stringent Anti-Money Laundering (AML) regulations.

This is a crucial phase that has two conflicting pressures, you must collect the data and perform the checks that the law requires but you must also provide a smooth and positive experience to your customers that will start your relationship from a position of strength.

However, the traditional manual methods of onboarding can be both time-consuming and resource-intensive, often posing challenges for firms seeking to balance compliance with operational efficiency and customer satisfaction.

Discover how Red Flag Alert has transformed onboarding through AML automation.

What is AML client onboarding?

Anti-money laundering client onboarding is a part of onboarding and is the beginning of the relationship between a service and a customer. Onboarding is the point at which a business must collect a range of important information about their customers as part of the customer due diligence (CDD) and know-your-customer (KYC) process.

By obtaining this information, firms can establish that their customers are who they say they are, are being truthful about the nature of the business in which they are involved and not engaged in illegal activity.

Practically, the onboarding process involves the following steps:

- Collecting and collating data and identification documents about a customer.

- Conducting background checks to verify customer-submitted data and establish beneficial ownership.

- Running historical checks to establish whether the customer has been involved in previous criminal activity, has sanctions placed against them or is a politically exposed person (PEP).

- Categorising the customer as high- or low-risk for ongoing AML screening and monitoring.

- Commencing the business relationship (if permissible) and applying appropriate AML transaction monitoring measures.

While onboarding is crucial to AML compliance and avoiding regulatory penalties, it is equally important from a customer service perspective. It is the first practical contact many customers will have with the organisation they have chosen to do business with and may influence their future decisions to continue using it.

As such, firms must consider the experience that customers have during onboarding and attempt to reduce or remove administrative friction by integrating technological tools and automating the process wherever possible.

Embracing automation in AML client onboarding can significantly enhance compliance performance while streamlining operational processes and improving customer experiences.

The Importance of Automating AML Client Onboarding

Automation is important during onboarding because it helps firms achieve compliance and customer service objectives. Implemented effectively, automation has the following effects and benefits during onboarding.

Enhanced Efficiency

Automation reduces manual effort and streamlines repetitive tasks, allowing AML processes to be completed faster and more accurately. This efficiency translates into cost savings and enables staff to focus on higher-value activities.

Improved Accuracy

Human error is inevitable, especially when dealing with vast amounts of data and complex regulatory requirements. Automation minimises the risk of errors by performing tasks consistently and precisely, leading to more reliable AML outcomes.

Real-Time Monitoring

Automated systems can continuously monitor transactions and customer behaviour in real-time, enabling timely detection of suspicious activities. This proactive approach enhances risk management and strengthens the institution's defences against money laundering threats.

Scalability

As financial institutions grow or face increased transaction volumes, manual AML processes may struggle to keep pace. Automation provides scalability, allowing organisations to handle larger workloads efficiently without compromising effectiveness.

Adherence to Regulatory Requirements

Compliance with AML regulations is non-negotiable for financial institutions. Automating AML processes ensures consistent adherence to regulatory requirements, reducing the risk of non-compliance penalties and reputational damage.

Risk Mitigation

By leveraging advanced analytics and machine learning algorithms, automated AML systems can identify complex patterns and trends indicative of money laundering activities. This proactive risk mitigation approach helps protect the institution's assets and reputation.

Timely Reporting

AML regulations mandate the timely submission of reports such as Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs). Automation accelerates the reporting process by generating accurate reports promptly, ensuring compliance with regulatory deadlines.

Audit Trail and Documentation

Automated AML systems maintain comprehensive audit trails of all activities, providing a transparent record of compliance efforts. This documentation is invaluable during audits, regulatory examinations, and internal investigations.

Adaptability to Change

The regulatory landscape and money laundering tactics evolve constantly. Automated AML systems can be updated and configured quickly to address emerging threats and regulatory updates, ensuring ongoing compliance and effectiveness.

Competitive Advantage

Financial institutions that embrace automation gain a competitive edge by operating more efficiently, mitigating risks more effectively, and demonstrating a commitment to regulatory compliance. This can enhance customer trust and attract new business opportunities.

How to Automate AML Processes with Red Flag Alert

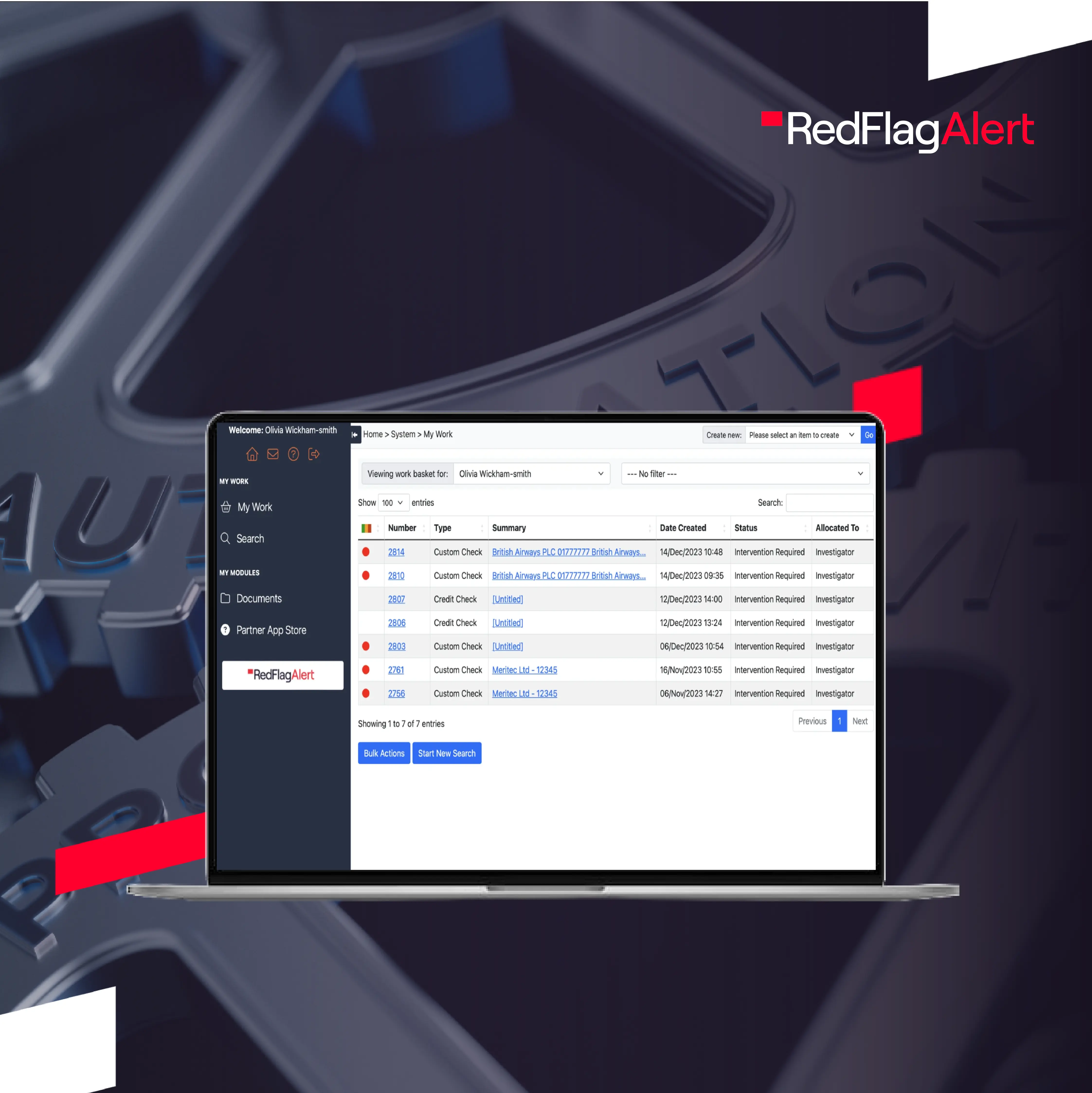

Red Flag Alert Automate takes your onboarding journey from days to seconds by automating your entire onboarding workflow, including your AML onboarding.

As part of this, our system automatically sends out branded AML checks to your customers without taking a second of your staff's time.

Once the preliminary checks are complete, ongoing monitoring with Red Flag Alert is automated to monitor customer behaviour and regulatory changes in an instant. This ensures that your AML processes remain effective and up-to-date in detecting evolving money laundering risks.

Red Flag Alert maintains a digital audit trail and users can easily develop automated workflows for investigating flagged alerts. This includes assigning cases to compliance officers, gathering additional information, and documenting findings, streamlining this process, reducing response times and ensuring consistency.

To find out more about how Red Flag Alert can upgrade your onboarding process get a free trial today