For many in the financial sector, 2022 was a tumultuous year to say the least. With global turmoil, the war in Ukraine, cost of living spikes and stock market bounces, it’s fair to say that this will be a year that many would rather forget. Or is it?

When reviewing the year, the news certainly isn’t all bad. The FTSE 100 has remained stable in the face of global volatility, and despite the war in Ukraine, energy prices are starting to stabilise. In fact, accountancy firm McKinsey found eight in ten surveyed CEOs reported that strong growth through new business building is a top priority for them going into 2023. In the same report, business leaders say they are building 50% more new business per year when compared with the past decade.

Despite some positive signs, it’s fair to say that there has been pain across industries. Tech layoffs, flailing stock prices, red-hot inflation and rising interest rates from historic lows have all rocked the market.

Let’s have a look at which companies have been big winners this year, flying the flag for growth amongst some of the toughest market conditions for decades. And then we’ll review some that maybe weren’t quite so lucky, former business titans whose demise got everyone talking.

We’ve reviewed these companies using Red Flag Alert’s data, using our unique scoring system, our own proprietary algorithm and data from sources like Company’s House.

Winners

These 2022 winners have been resilient in the face of market uncertainty and have grown strongly despite widespread concerns about the cost of living, and the sustained contractions of economic activity.

BAE Systems

BAE Systems is a mammoth organisation and continues to grow. Specialising in technology-led defence, aerospace and security solutions, they employ 10,000 people in its Warton and Samlesbury sites. Thanks to various global events, including the war in Ukraine, their yearly growth has been massive. After increasing sales from £21.3bn to £23.3bn, and reporting a revenue growth of more than 4%, their order intake also steeply rose from £21.5bn to £37bn.

The company won a recent F-35 jet maintenance support contract in April 2023, worth £161million and creating 140 jobs. They also work closely with the Ministry of Defence, and governments in Qatar, Japan and Italy under the Global Combat Air Programme.

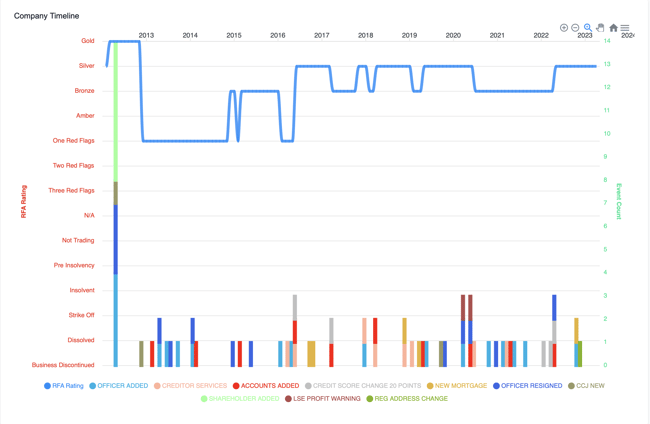

In the Red Flag Alert software, we measure success as well as decline. BAE Systems in our platform has been a steady and consistent performer, peaking at ‘Gold’ status, and never dropping down to anything resembling concerning.

Below we can see a graph of BAE Systems Red Flag Alert rating over the last ten years. After a difficult period between 2013 and 2014 BAE Systems has held a consistently high rating. Despite dropping from Silver to Bronze during the pandemic, they never became a concern for failure and emerged to perform strongly in 2022.

BP Oil

Oil giant BP were a clear winner this year, posting huge profits of $27.7 bn (£23bn), up from $12.8bn in 2021, and hiked their dividend payments to shareholders.

It’s not entirely surprising as competing companies in the same sector also had good years, with Shell and British Gas also reporting record profit. This is partly due to an increased demand after the pandemic, and energy price surges after the Russian invasion of Ukraine.

The record profit has been met with some backlash, due to households struggling with energy prices during the cost-of-living crisis, with calls to introduce a windfall tax on the sector. The EU implemented such a measure, with a 33% levy on any profits made from fossil fuels.

Environmentalists criticized CEO Bernard Looney as they announced a role back of their previously announced plan to pivot away from oil and into the renewables market. BP scaled back plans to invest $1bn in low-carbon options away from traditional gas, dropping 15% of their 2030 target to produce the equivalent of 2million barrels of oil per day.

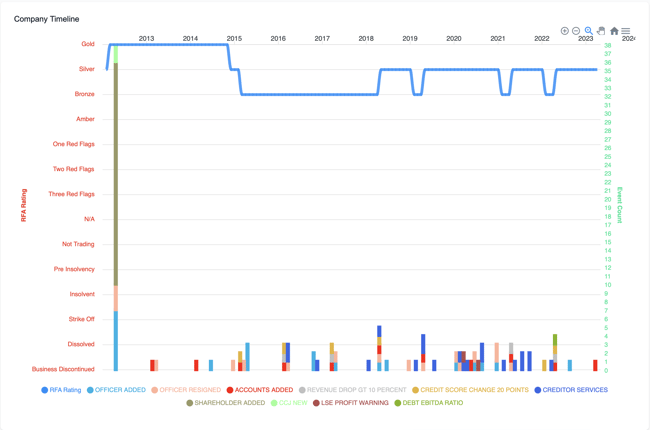

When viewing them in our platform, unsurprisingly, BP is steady and never drops out of the top ratings for an organisation’s financial stability.

Below we can see a graph of BP Oil’s Red Flag Alert rating over the last ten years. BP has never held a rating that had them as at risk of failure and they managed to hold a silver rating throughout most of the pandemic and have continued to hold this as the global economy emerges form the effects of COVID.

HomeServe

One of the lesser-known winners of last year was HomeServe, a business who focuses on home repairs for boilers and other appliances.

The Walsall-based business was offered £4.1 billion for a takeover by Brookfield, due for completion in 2023. Alongside this, HomeServe reported exceedingly strong growth and profit turnover for the recent financial year. They had a profit rise of 19%, to £22.4m, with revenue up by 17% to £714.4m. Growth was reported in all major continents, including Europe, the Middle East and Africa.

The company also reported that customer numbers ended the year at 1.5 million and policy retention rose to 79%, an improvement on years past.

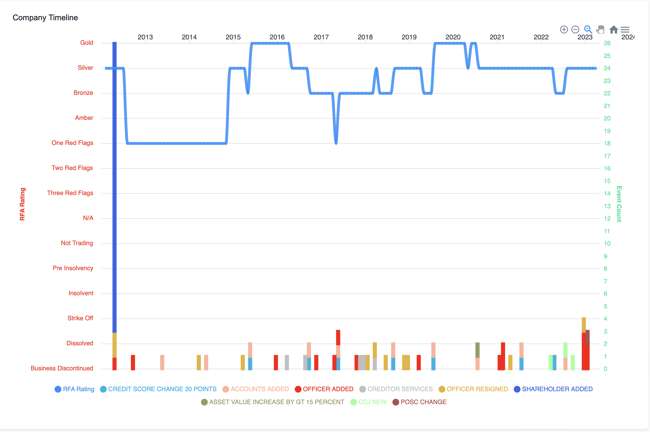

A quick review of HomeServe in Red Flag Alert shows that after a slow start, they have strong and maintained performance for the past near decade, with no warning signs. This will presumably continue once their takeover is complete.

Below we can see a graph of HomeServe’s Red Flag Alert rating over the last ten years. HomeServe maintained a strong performance through the pandemic and into 2023. More time spent at home during lockdown aided their business, as people sought quick home repairs at reasonable prices.

Losers

Not everyone can grow, especially in periods of recession. The economy does unfortunately consume and eliminate some organisations, even those that are household staples. We at Red Flag Alert believe that no one is too big to fail, and we’re being proven correct time and time again.

Paperchase

Classy stationery and gift company Paperchase, once a high street industry leader, officially entered administration this year. After talks, Tesco stepped in with a deal to buy the brand and intellectual property, but no buyers were interested in purchasing the physical assets of the business, including the 106 retail locations. This caused hundreds of staff across the UK to be made redundant.

Paperchase appointed insolvency practitioners from Begbies Traynor Group who released this statement:

“Unfortunately, despite a comprehensive sales process, no viable offers were received for the Company, or its business and assets, on a going concern basis. However, this sale reflects the interest in the well-known and established brand and will enable the brand to continue in Tesco stores across the UK.”

The organisation had typically faired quite well within the Red Flag Alert platform, staying steady at ‘One Red Flag’, and then briefly rising to a Bronze thanks to strong financial performance. It wasn’t until until early 2023 when the warning signs started to show. The company quickly slipped down our scoring metric, and we saw the administrators called in.

Below we can see a graph pf Paperchase’s Red Flag Alert rating before its demise. Having been previously bought out of administration a few years ago, the company was not able to find the high street successes of old and finally collapsed as an independent business.

Made

From the highs of being a pandemic success story, to one of the most high-profile insolvencies of last year, the demise of Made was a shock for many. The high-end furniture company was only recently publicly listed with a valuation of £775million.

However post-Brexit freight costs and supply chain difficulties sent costs soaring for the online retailer, with huge delays to shipping leading to a poor customer experience. No one could accuse Made of not adapting with the times, as the online-only retailer was digital first, with no physical presence on the high street. External forces, including the declining demand for expensive furniture as a result of rising customer bills, was the final nail in the coffin for the once soaring retailer.

Made.com was put up for sale in September 2022, but a buyer could not be found, and, after three profit warnings, they announced serious cashflow problems and the administrators were called in.

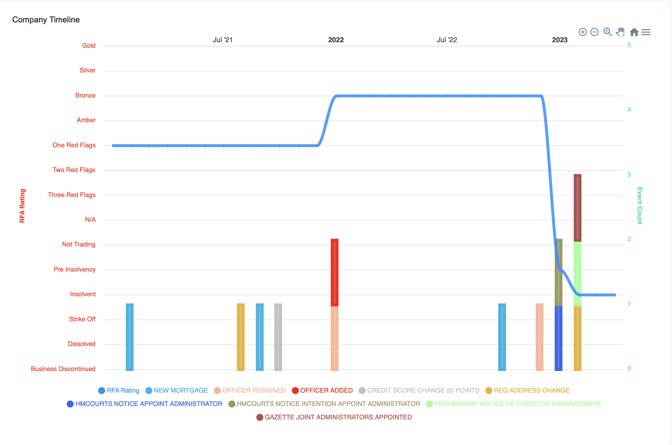

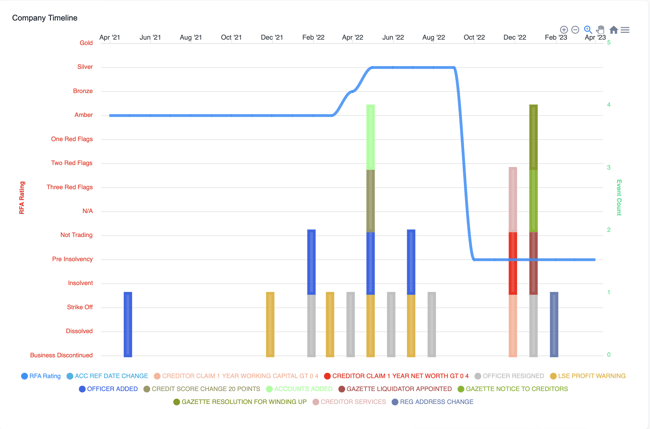

When referring to Made in Red Flag Alert, we can see that the company performed strongly for the majority of 2021 and 2022, even rising up the ranking system to a ‘Silver’ rating just before the big crash of September 2022. There were some notable events, but it wasn’t until the official announcement that organisation really began to fail.

Below we can see a graph of Made.com’s Red Flag Alert rating over the last two years of its existence. Despite appearing to be on an upwards trend a sudden drop in demand led to a catastrophic failure.

Missguided

Once a gem of fast fashion, and a popular employer on the Manchester tech landscape, Missguided had an up-and-down history. Founded by Nitin Passi in 2009, at one stage they were one of the biggest online players in female fashion, offering out huge sponsorships, such as Love Island.

However, after multiple competing brands made significant dents into Missguided’s profit, with supply chain costs and rising inflation, at least three of their suppliers warned they were at risk of insolvency due to delays in outstanding payments.

The retailer ended up appointing administrators, with a loss of 330 staff, after suppliers ran out of patience and filed to shut it down due to unpaid debts. Their CEO quit, and the firm collapsed, with millions still owed to its debtors, including the suppliers.

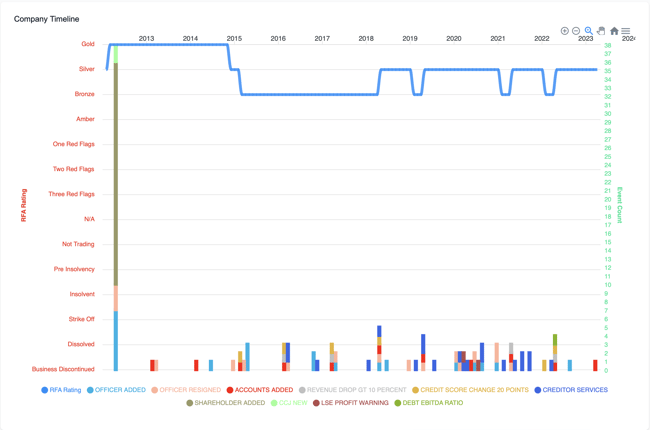

Missguided, when reviewed through Red Flag Alert, shows an up and down journey. Steady for many years, from 2015 – 2018, rising up to a ‘Silver’ ranking, and then slipping down to the more worrying ‘Two Red Flag’ rating, until finally plummeting in mid 2022.

Below we can see a graph of Missguided’s Red Flag Alert rating over the last ten years. Since 2018 it had been a company struggling to stay afloat and was unable to capitalise on the fast fashion boom of lockdown.

Was 2022 a winning or a losing year for your organisation? If you didn’t grow as much as expected, the current economic environment could be to blame. Don’t worry, there are tools at hand that can help support your journey for the next financial year and protect your company from partnering with anyone who could hurt you.

Discover how Red Flag Alert’s unique platform can provide real-time access to unique sales and financial data, help you to mitigate risk and protect your business. Why not get a free trial today and see how Red Flag Alert can help your business?