Identity verification is an essential part of doing business today - both for firms with anti-money laundering obligations and many others.

In simple terms, ID verification allows you to check that somebody is who they say they are. For banks and financial institutions, this process is also known as Know Your Customer (KYC).

In most cases, the identity verification process involves reviewing a person's identity documents. The individual concerned may also need to complete various forms to provide additional information pertaining to their identity.

In this article we explain the importance of identity verification, and explore how valid checks can be administered online.

Why Does Identity Verification Matter?

Identity verification is a fundamental and legally required part of the UK’s anti-money laundering regime. The UK is a world centre for money laundering, with the National Crime Agency estimating it’s cost to the UK stands at £100 billion per year.

Identity verification aids in the fight against money laundering by allowing companies to verify that the person they are doing business with is who they say they are, that it is not suspicious they are involved in that transaction and that they have no sanctions against them.

Identity verification is a crucial part of the risk-based approach that companies in the regulated sector are obligated to take under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) regulations 2017.

If a company in the regulated sector is not carrying out the necessary identity verification checks, then they are not compliant to UK law. Should they be found to not be meeting these obligations they can face fines and professional disqualification; should they be implicated in a money laundering scheme due to lack of compliance then responsible individuals at the company, including directors, can face lengthy jail terms.

Which Regulations and Standards Apply?

The UK has stringent and robust anti-money laundering laws that enforce harsh punishments on those found to have broken them. The UK legal system defines anti-money laundering efforts as a joint endeavour between the public and private sector and as such a huge amount of responsibility is placed on business. The major pieces of legislation are:

- POCA

- Proceeds of Crime Act 2002. A major piece of legislation. Defines what the proceeds of crime are and grants authorities to investigate, freeze and seize criminal assets.

- MLR

- The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) regulations 2017. The second major piece of legislation relating to and governing AML activities. The aim of the MLR is to stop professional services being used to launder money, and to introduce the risk-based approach methodology companies in the regulated sector are required to take.

- CFA

- The Criminal Finances Act 2017. This affects all UK businesses and grants further powers to investigating authorities and expand the reach of existing money laundering legislation.

Performing IDV checks and having robust internal anti-money laundering procedures are required under these pieces of regulation.

How Does Online Identity Verification Work?

It has long been best practice to check the documents of those you deal with in a financial transaction, but recent events have bolstered the need for digital identity verification. Identity checks no longer need to require delays in conducting business while a potential client finds the time to physically visit an office to show documentation which then has to be laboriously manually checked.

The Digital IDV process is broadly similar to the checks that you might expect from an in-person meeting, with the exception of a few key differences. Firstly, it requires the use of a live video stream so the person conducting the check can see both the subject and a valid identity document. In some cases, individuals may also be required to provide an electronic signature or provide face authentication using technology that is similar to the systems used for unlocking smart phones.

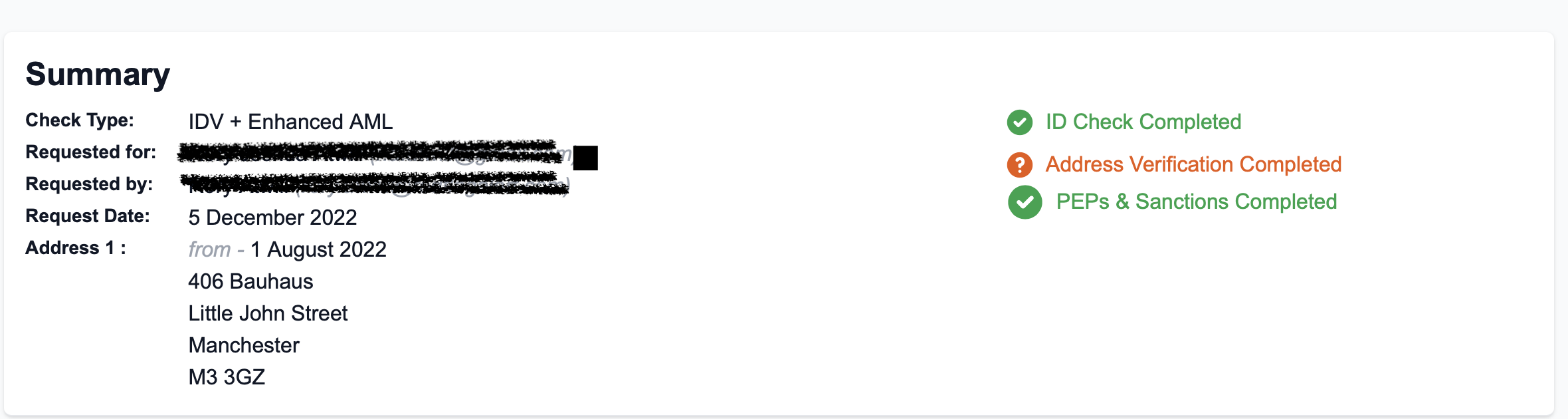

With Red Flag Alert's digital ID checking service, the online identity verification process is simple:

- To begin with, the AML officer enters a customer's basic details into an online form.

- The customer is then sent a branded email that directs them towards an online portal where the verification process can be completed.

- Customers are instructed to two identity documents using the camera on their device. This means that these checks can be completed on the go, and without the need to access a scanner. The following documents can be used:

- Passport

- Driving License

- Meter Point Administration Number (MPAN) number

- European ID Card

Red Flag Alert’s digital IDV solution allows a check to be performed in minutes and saves on time and money by letting potential clients digitally upload their documents themselves. These are then checked by our advanced AI technology and a full report is created and delivered to you.

- Red Flag Alert's AI application identifies, verifies, and securely stores the key data from the customer's documents.

- The system returns a pass or fail. In the case of a fail, the business can go on to file a Suspicious Activity Report (SAR) with the National Crime Agency.

- Customer data can also be inputted manually, making it easy to finalise checks in cases where you already have the relevant details.

The process is fast, efficient, and can be conducted remotely over the internet without the need for customers to attend in person for identity checks to take place.

Who must perform identity verification checks?

UK anti-money laundering law requires the regulated sector to comply to anti-money laundering regulations. Professional bodies within the regulated sector also have additional requirements of their member companies.

The regulated sector is defined as:

- Art market participants (buying, selling, or storing art worth €10,000 or more)

- Auditors & external accountants

- Casinos

- Credit institutions

- Estate agents

- Financial institutions

- High value dealers (handling cash payments of over €10,000 or more)

- Independent legal professionals

- Insolvency practitioners

- Letting agents

- Trust or company service providers

Use Cases and Applications

Since the advent of lockdowns and social distancing at the beginning of the COVID-19 pandemic, digital solutions have become an ever more important part of our day to day lives.

The trend towards online business has carried over into the world of AML compliance and identity verification, and various organisations have been forced to find new ways to conduct Know Your Customer checks. The following industries in particular have experienced increased demand for digital ID checks:

- Banking and financial institutions that are required to verify the identity of their customers before completing transactions or opening new accounts.

- Government departments and public authorities that require customer ID validation when issuing new documents and assessing applications for financial support and other assistance.

- Private companies when conducting Right to Work checks during onboarding and throughout the procurement process.

Fraud Prevention with Online ID Verification

The world is changing and business has gone online. While many organisations have adapted to the new normal by conducting identity checks using webcams and conferencing software, that is by no means a permanent or fully secure solution.

By using Compliance Software from Red Flag Alert, businesses can benefit from an easy automated process that conducts the necessary KYC and document verification checks without the need for a Zoom call. It's a simple and highly secure process that allows firms to comply with all relevant regulatory standards while providing a fast and efficient user experience for everyone involved.

When used in conjunction with Red Flag Alert's wider suite of AML compliance tools, organisations can count on:

- Full identity verification

- Enhanced due diligence

- Real-time screening for PEPs and sanctions

- A full range of risk level checking

- A secure audit trail

- Time and cost saving automation.

- Unbeatable match rates

Learn more about how Red Flag Alert helps you protect your business from financial risk and comply with regulations, why not Try Red Flag Alert today