As part of our mission to provide our customers with the most accurate insights and most useful tools, we constantly strive to develop and introduce new and exciting features to our platform.

We are delighted to announce our newest feature: the ability to interrogate and monitor late filed accounts data.

A company filing their accounts late can be a key sign of distress and is important to track in your business partners as well as include in your financial due diligence processes.

This new feature includes:

- Search Account Due Dates - Users can search for the due dates of accounts, helping them stay informed about upcoming deadlines.

- Portfolio Manager Notifications - Users will receive notifications within the Portfolio Manager when a company's accounts become overdue. This feature is particularly useful for accountants managing multiple clients or portfolios.

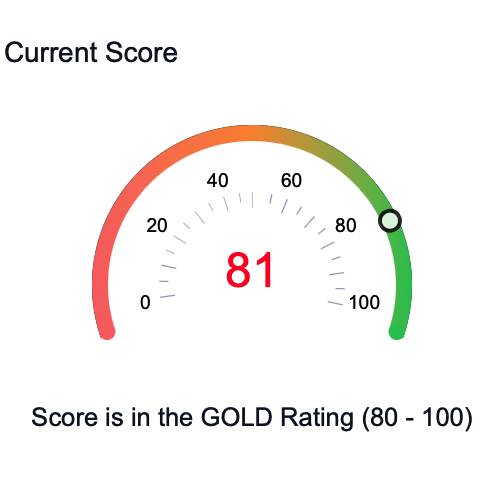

- RFA Scores Integration - The late-filed accounts data will be incorporated into Red Flag Alert (RFA) scores, serving as an additional indicator of risk. This enhancement will add more depth and reliability to the existing scoring system.

Why late filed accounts are significant

Companies face strict legislation around when their accounts must be filed and will face punishment if they fail to comply with this.

- Private companies and LLPs must file their accounts no later than 9 months after the end of the accounting year.

- Public companies must file their accounts no later than 6 months after the ed of their accounting period. A PLC’s accounting period is defined by the date exactly 21 months after their date of incorporation.

As you can see, these timeframes provide companies with a significant amount of leeway after the end of the financial year/accounting period to get their affairs in order and submit their financial results.

Yet each year between roughly 150,000 and 200,000 companies file their accounts late.

Late filing companies face a range of penalties that increase in severity the more often a company or director fails to submit results on time.

- Every late filing company is fined, up to £1,500 for private companies and £7,500 for public companies. This is doubled if they were late the proceeding year.

- Companies who file late risk being struck off.

- Directors who consistently file late risk being banned.

As well as these there are many other negative effects caused by late filing.

- A decrease in business credit score

- Reputational damage

- Fall in share price (for PLCs)

- Companies become hesitant to do business with a late filing company

So, given all these negative consequences, why do companies consistently file late? The three most common reasons are:

- Delaying publishing negative results

- Poor organisation or a lack of understanding of business process and requirements (this is especially common of micro-businesses)

- A mistake on behalf of their accountant

Whatever the reason, late filed accounts suggest a clear risk to you and these new features mean you will be able to do even more secure and safe business, try Red Flag Alert today for free.