Chancellor Jeremy Hunt is set to unveil the Spring Budget in the Spring Statement on Wednesday 15th March. After 2022 seeing four separate Chancellors, the fact that Mr. Hunt has survived to deliver his second fiscal event is being seen as positive by the wider business community.

Jeremy Hunt’s Autumn Statement was largely seen as an effort to steady the ship after the post-COVID post-mini budget, political and economic turmoil. The Spring Statement is expected to be the Sunak government looking towards the future. The Prime Minister, Rishi Sunak, has already unveiled his ‘5 Core Principals’ which involve some ambitious economic targets: to halve inflation and have the strongest growth of the G7.

With twenty months until the next general election, the Spring Statement will need to lay the foundation for these to begin to be delivered upon and delivered upon quickly.

The goal of the UK achieving the highest growth rate of any G7 country is especially ambitious as our national economic growth has been relatively stagnant since the Financial Crisis of 2007-2008, certainly much below that of the other member nations. The question must be asked of how the Sunak government can achieve this when the previous iterations of this Conservative government have failed.

Dr Nicola Headlam, Chief Economist at Red Flag Alert, advises that, ‘To understand exactly where growth and decline is in the economy, government must stop looking at the national aggregate and instead review firm-level microdata.’

Whether or not the UK is in a recession and if the economy is growing or declining has become the primary economic focus of media and political debate, but by concentrating on the national aggregate figure the supposition is that the whole of the UK, both geographically and by sector, is experiencing the same growth of shrinkage when in reality there are significant disparities across the country.

Research by Red Flag Alert and its sister company Growth Flag into the economy across all local enterprise partnerships (LEPs) in the UK that there is a distinct K shaped economy, where the regions and sectors doing well are continuing to do so and seeing growth whilst those that are struggling will continue to decline.

Dr Headlam added, ‘Our data clearly shows we have a diverging economy and that there is much more going on under the surface of the national aggregate figure and that there are clear disparities between the LEPs across the UK.

‘However, it also shows that the potential for growth is spread across the country and raises the argument that government investment should be handled at a local level to unlock this.’

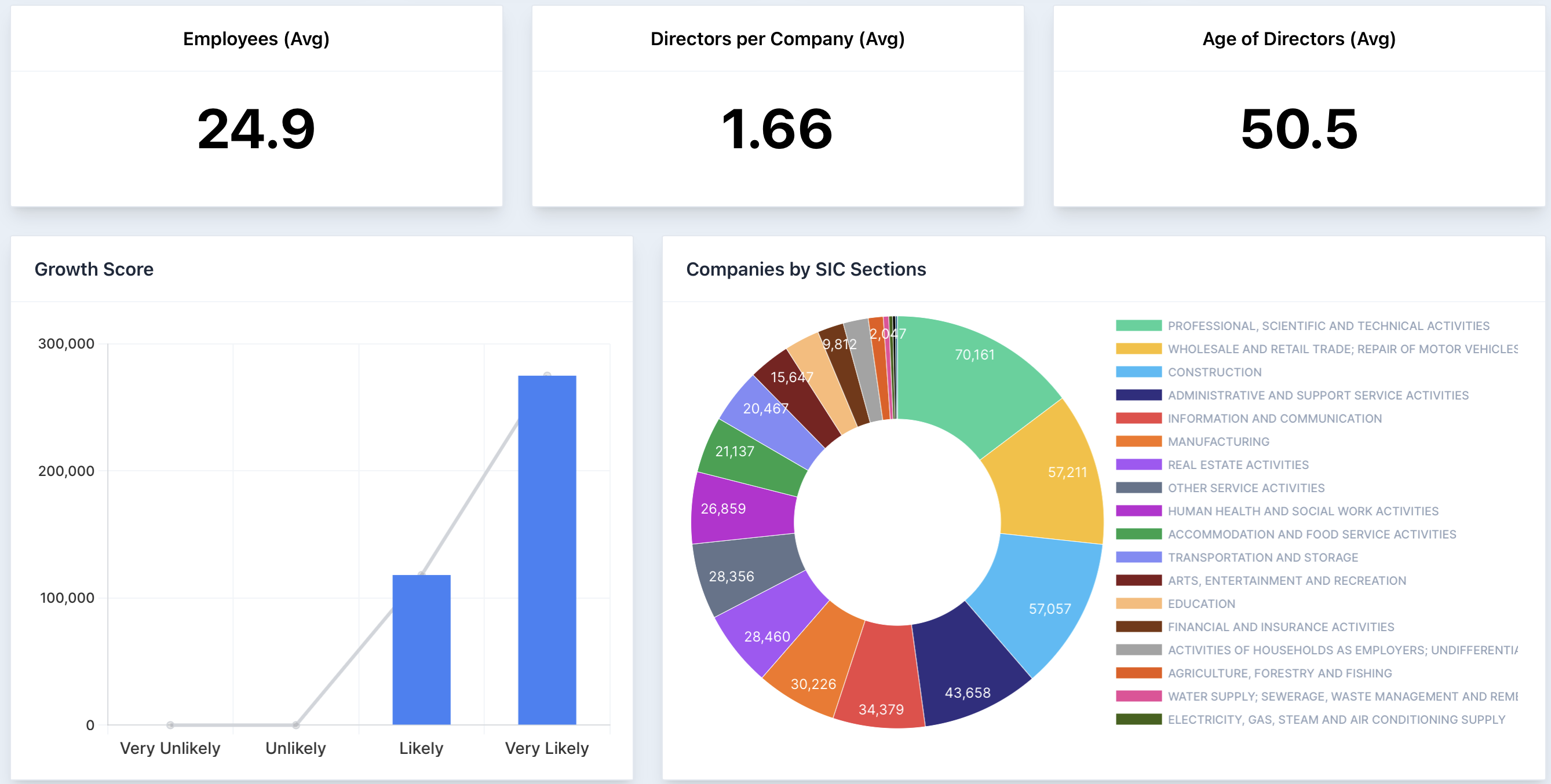

Red Flag Alert and Growth Flag found that the three sectors with the highest amount of potential for growth are: wholesale and retail trade (19.02% of all companies), construction (17.27%) and professional, scientific, and technical activities (15%). With a total of 330,000 across all sectors showing high growth.

A view of growth in the UK by sector, on the Growth Flag Platform

The government has advised its focus for growth is on Fintech, Regtech, science and green advancement, sectors that traditionally underpin The City, but this ignores 85% of all UK companies that are showing signs of growth.

Mark Halstead, Director of Data at Red Flag Alert, said. ‘By not focusing on the details of the economy, the government is overlooking key areas that need support. It is immensely important that the ability to fund business is devolved to local organisations that are best able to invest effectively.’

Mr Halstead and Dr Headlam advised that there are two key areas they would like the Chancellor to address in the Spring Budget to spur growth: education and the tax incentive regime.

The government must bring its policy around childcare in line with that of Europe when it comes to funding early age childcare and education. The average cost of a 50 hour per week childcare spot is over £14,000; this means that UK businesses are missing out on key skills and a huge amount of employees that wish to work but simply can’t afford to. Similarly working parents are being hamstrung as many are unable to return to the workforce full time due to this cost. In a job market with over a million vacancies the government must do all it can allow all those who wish to work to do so.

Adding to the vacancy crisis is the fact that there are not enough young people entering key roles and industries to replace those that are retiring or fill new jobs roles. Not only is this hampering the ability of companies to grow but leads to increased prices as there are fewer companies able to carry out services and thus able to charge more.

An issue is that late-stage education does not prepare 16-18 for the employment market or educate them as to the possibility of a career. Without knowing the opportunities that are open to them young people do not enter the workforce where they are needed.

The construction industry is an example of this. Along with increased material and fuel costs growth in the sector is being suppressed by a lack of apprentices training to fill traditional roles (such as plumber, electrician etc.) or new hi-tech roles (such as drone operator). There is an abundance of vacant roles in this sector that earn well above the national average and have significant opportunity for professional development; yet this is largely unknown by school leavers.

There has been talk of scrapping the apprenticeship levy, but Mark Halstead considers this to be a mistake, ‘The issue with the current apprentice scheme is one of delivery not value. It is poorly understood, and businesses find it difficult to access. Apprenticeships are the future of the jobs of tomorrow and Jeremy Hunt will be better served consulting business as to how to make it fit for purpose rather than its withdrawal.’

On the current tax regime, he added, ‘Whilst there is much fear around a corporation tax of 25%, this may not be as detrimental as feared. However, of greater concern to me is the proposed scrapping of the R&D tax credit and the super-deduction.’

These are two of the few government schemes that actively encourage companies to grow. The R&D tax credit allows 33% of R&D costs to be deduced from tax and the super-deduction allows for 130% of certain investments into a business to be claimed back. Without these schemes it may be simply too expensive for businesses to attempt to expand.

‘In isolation a 25% corporation tax may allow for growth; a 25% tax rate combined with the withdrawal of these schemes is not a feature of a growing economy, it is a feature of an economy on its knees.’ Advised Dr Headlam.

‘Whilst we found 330,000 businesses that experienced high growth it is important to note that this was largely funded via their own turnover as opposed to government initiatives. We found a further 175,000 businesses, many over 10 years old, that showed the capacity for strong growth but were effectively run as lifestyle businesses.

‘This shows that there is a sever lack of incentive for good companies grow and drive our economy. By focusing on the top line, the government has adopted a facile view of our economy. There is a strong feeling within the business community that this is a make-or-break time for the Sunak government and that investment is now or never for Chancellor Hunt.’

To Learn more about how we can help you find Growth, whether it be in your local economy or for prospective clients get a free trial today or read our guide to Regtech.