Common causes of business failure consist of missing the key signs illustrating that the business is nearing financial difficulty due to debt build-up and failing the cash flow and balance sheet test for insolvency.

These prescribed tests assess whether the business is operating responsibly and if it requires a helping hand from a professional expert, a cash injection or an upgrade to financial reporting software with access to intelligent due diligence tools.

Cash flow test

A cash flow test will assess the level of cash held by the business to fulfil essential liabilities, maintain the daily running of the business and pay creditors. If your business is struggling to pay bills due to cash flow limitations and no longer has enough cash to keep the business afloat, it may be edging closer to collapse. The cash flow test for insolvency is a starting point to determining the financial health of the business as if there is no cash to replenish stock, this can halt trading and push the business into decline. This test will also take into consideration contingent liabilities as if an upcoming bill is likely to push your business into the red, the test will indicate this.

Balance sheet test

A balance sheet test will take into consideration incoming cash against outgoings, ensuring that the business is spending within its means. If the business is cash strapped due to overspending, the balance sheet test will reflect this and if the business has more liabilities than assets, this is a clear warning sign of a business diving into choppy waters. Assets taken into consideration include anything of value owned by the business which can be realised to generate funds, such as vehicles, machinery, equipment and property. Businesses with more liabilities than assets are generally supported by an abundance of cash, but if the business is cash poor – this is an indicator of poor financial health.

Empty reserves pot

It is instrumental for businesses of any size to contribute funds towards a reserve pot for a rainy day, periods of low consumer demand and challenging economic circumstances, such as the coronavirus pandemic. If the business is out of cash, asset poor and has no emergency funds to fall back on, it is left to depend on emergency borrowing to survive. If the business has an empty reserves pot and is already experiencing significant financial distress, it may be on the verge of collapse. As we continue to face challenging trading conditions, a possible second coronavirus wave could push the business into becoming insolvent due to lack of emergency finance.

Legal action and creditor pressure

If your business is currently in the firing line of legal action from creditors, failing to comply could result in the slow deterioration of the business, forcing your hand to opt for company liquidation. Failing to repay outstanding funds to creditors could result in creditors to issue a winding up petition to recoup the money. If the court grants a winding up order against your business, this could result in compulsory liquidation. A Statutory Demand and County Court Judgment are both forms of legal means which can be used to demand payment, resulting in serious consequences if ignored.

Dependence on temporary financial support

If withdrawing your business from financial support could result in your company to flatline, your inability to survive without a constant stream of borrowed cash could lead to your collapse.

Businesses with high dependence on such forms of emergency finance are likely to fail as constant cash injections result in the rapid accumulation of debt which is unlikely to be repaid.

Unable to repay Covid-19 loans

If you accessed finance through government-led, Covid-19 support schemes, such as the Coronavirus Business Interruption Loan Scheme (CBILS) or the Bounce Back Loan Scheme (BBLS), you will need to seriously consider your repayment strategy before you start facing interest fees after the grace period ends. Taking into consideration contingent liabilities, if your business will no longer be able to keep up with payments, you should seek advice urgently before your business enters an irreparable state.

Operational decline

If business operations are intact, functional and well managed, this could lead to spotting early signs of financial struggle and enforcing the necessary preventative measures before the business experiences financial distress. If the operations of the business are unmanaged and the financial reporting is carried out on an irregular basis, you could fail to spot red flags illustrating that the business is likely to fail due to cash flow limitations and outstanding arrears which can no longer be compensated for.

Protect your business from risk

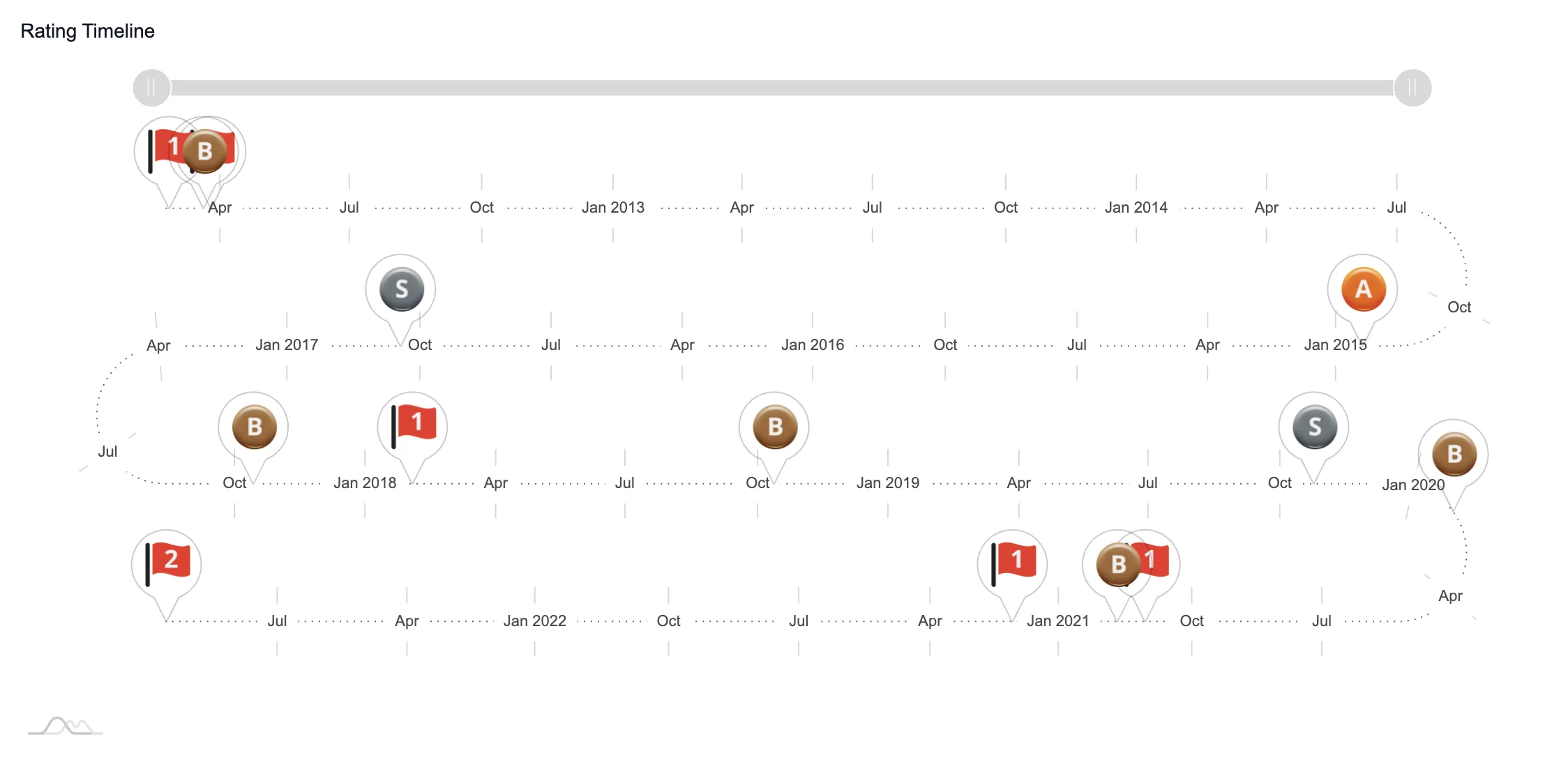

Our advanced credit scoring & monitoring platform

It is vital to enlist a qualified accountant to ensure that the correct reporting strategies are in place to track the financial health of the business. Failure to do so could result in worsening the position of creditors, jeopardising your role as a company director and the future of the business. There are clear signs which indicate the eventual collapse of a business which can easily be interpreted by company stakeholders and tracked by accounting reporting software.

Discover how Red Flag Alert’s experienced team can help you mitigate risk and protect your business. Why not get a free trial today and see how Red Flag Alert can help your business?