Without credit, most businesses wouldn’t be able to function. But with that comes credit risk; there is a chance that goods or services could be offered and not paid for. Credit reference agencies help businesses avoid being associated with bad debt by providing a range of information, which can be used to make a decision about whether an organisation is credit-worthy or not.

But what is a credit reference agency and why are they important?

Here at Red Flag Alert, we’re proud to be the UK’s only independently owned credit reference agency for business credit checks.

Identifying unreliable suppliers and clients early saves time and money; it helps companies avoid bad debt or having to chase late payments. These tools are valuable and can be used to make informed and risk-averse credit decisions. But to ensure a return on your investment, it's critical to find the best business credit report.

It's important to understand exactly what a credit reference agency (CRA) is, what credit reference data is used for and how Red Flag Alert uses this to stay ahead of the competition.

What is a credit reference agency?

A credit reference agency (CRA) is an independent organisation that analyses data about businesses, including credit applications, accounts, and financial behaviour, to predict if they are a credit risk.In fact, we outperform credit referencing agencies such as Creditsafe in a variety of ways.

Usually, CRAs provide tools such as:

- Company credit check

- Credit service data, insolvent, bad debt (weekly feed), alert-publish

- Domestic AML checks

- Global PEPs and sanctions check

- Global identity verification

- PEPs, sanctions, and adverse media monitoring

Red Flag Alerts provides these tools and much more, staying ahead of the competition both in platform functionality and customer satisfaction.

Some of these tools include:

- Same-day event alerts

- Next-generation user interface

- User-friendly platform

- Portfolio management – company monitoring.

- International AML checks

- Adverse media checks

- Bulk CSV, PEPs, sanctions, and adverse media check

- Moratorium data

- Unadvertised petitions

- Proven insolvency score

What are CRAs used for?

Delayed payments from clients will start to affect your ability to pay your suppliers on time and make it more difficult to plan as cash flow becomes unpredictable. CRAs also allow a business to mitigate the risk of bad debt, where a debtor goes insolvent. This lowers the risk of losing money to bad debt by only offering credit to financially strong companies.

Businesses use credit referencing agencies to protect their financial health. Some crucial reasons businesses use CRAs are:

- Check and monitor the creditworthiness of business partners.

- Especially ones that are susceptible to financial fluctuations and trade breakdowns.

- Monitoring and checking business financial accounts helps the company avoid financial/legal issues.

- Save time and money which could be wasted chasing late payments.

- Supplier checks

- Important with ongoing supply chain issues as companies don’t want to be left unexpectedly as this has major repercussions and can push businesses into insolvency.

- Director search

- Even if a new company looks reliable, if the director has a history of involvement with multiple insolvent companies, it is useful to know.

- Credit score and business reports

- These are financial assessments that give a summary of a business’s potential and profitability. It also highlights critical points of risk that will assist a business in making information-driven decisions.

Some CRA business reports also contain trade payment information. This provides the opportunity for you to learn about existing or potential business partners' payment behaviour. From this, you can make sure to only offer credit to companies that can be relied on to make payments on time. Through this knowledge, it is possible for a business to predict cash flow and use this as a basis for future planning.

What do Credit Reference Agencies use credit reference data for?

Credit reference agencies (CRAs) use credit reference data to create information for business reports and credit ratings.

A company credit rating shows how creditworthy a business is, a CRA provides this via a company credit report. CRAs have a database of financial information that they analyse when calculating a company’s credit score. This specific weighting framework and algorithm means that although companies may have access to the same information:

- All financial data

- Company size

- Industry characteristics

- Regional specifics

- Corporate structure

- County court judgements (CCJs)

- Mortgages

Credit reference agencies will give each company a rating as part of the company report. How these ratings are calculated and presented varies from CRA to CRA. The purpose of these scores is to quickly summarise how creditworthy a company is.

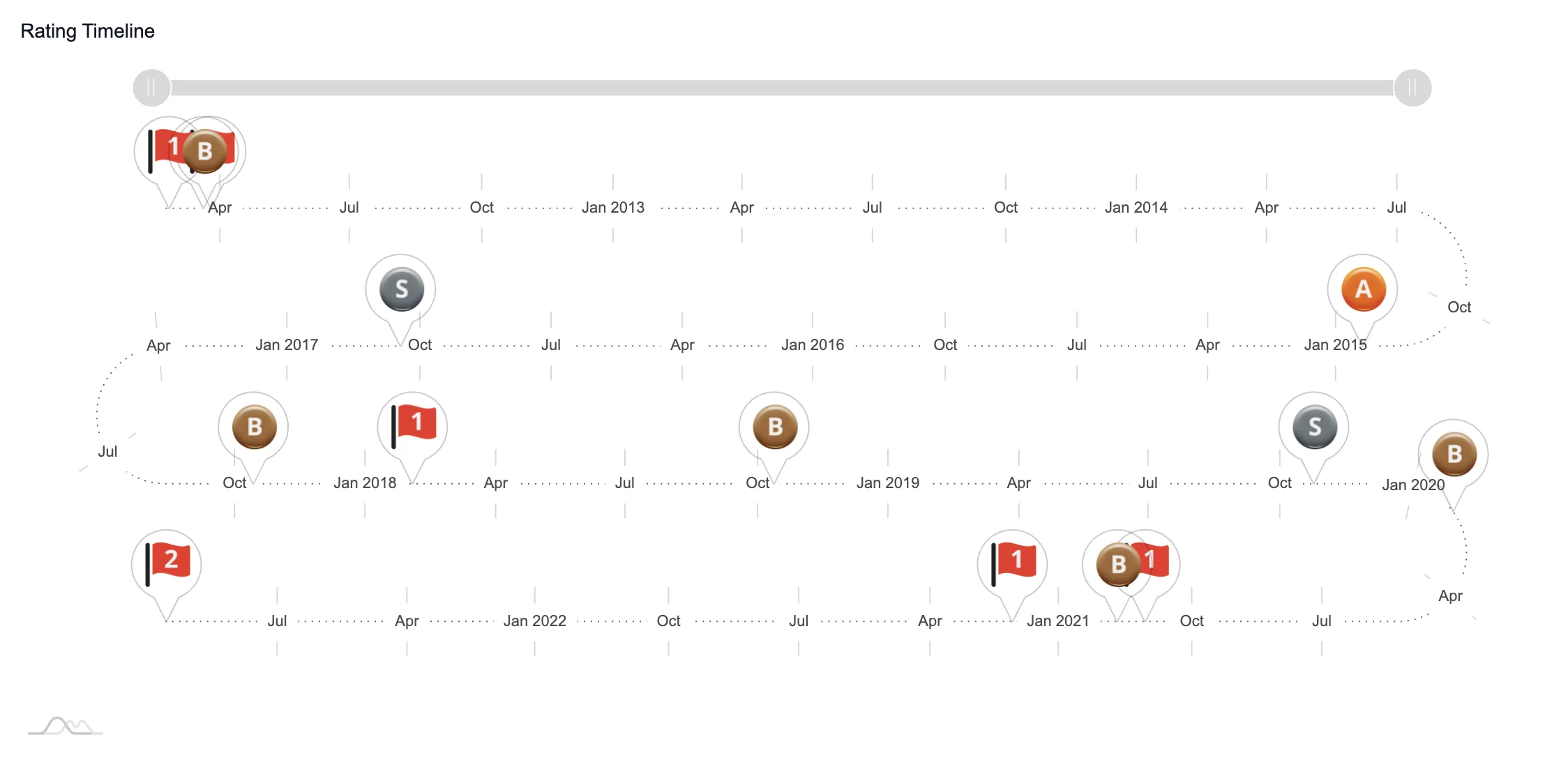

Rather than present the credit score as a number, which different people can interpret differently, Red Flag Alert uses a unique rating system where each company’s creditworthiness is put into clearly defined and easy-to-interpret categories. Red Flag Alert's award-winning platform uses real-time data to calculate a company’s credit risk.

How Red Flag Alert stays ahead of the competition

Red Flag Alert is the UK’s only independently owned credit referencing agency. With 25 years experience in business intelligence, over 9,000 UK business users and a database of over 15M businesses with 180,000+ daily updates. Our cloud-based business intelligence software helps clients become data-driven by delivering in-depth information with real-time updates to inform sales, credit risk, and compliance to make better business decisions and manage risk early.

Benefits include:

- Full company reports

- Growth score

- International search

- Live updates

- Portfolio monitoring system

- Digital KYC, AML, and PEPs and Sanctions checking.

- CRM integration

Discover how Red Flag Alert’s experienced team can help you mitigate risk and protect your business. Why not get a free trial today and see how Red Flag Alert can help your business?