Enhanced Due Diligence

Performing enhanced due diligence is a vital KYC process in identifying bad actors, and protecting organisations from financial crime to help minimise the risk of financial sanctions and lawsuits.

Vetting customers before working with them and continuous monitoring is essential to help protecting your own company from risk. Enhanced due diligent checks are often needed when dealing with clients or suppliers from high risk business sectors or countries.

60000

Daily Updates

9000

Users Worldwide

15m+

UK Businesses

The RFA database uses an algorithm created in-house to provide extensive information to highlight risk and changes in status fast, protecting our customers and their business interests.

RFA’s EDD checks go beyond the enhanced due diligence checks performed by many companies, using a wider range of data points to identify and report potential risk before it happens. Using high quality data sources and in line with the 6th AML directive, RFA offer fast, up to date enhanced due diligence checks to keep organisations compliant and out of danger.

Why Red Flag Alert?

The RFA EDD database quickly identifies potential risk from persons including:

PEPs (politically exposed persons)

People with high profile political or public roles

SIPs (special interest persons)

Those who have previously been accused or convicted of financial crime, or have court proceedings related to financial crime

Sanctioned individuals

A person subject to financial sanctions

Bad media

An individual with high levels of negative media coverage

Ultimate beneficial owners

The person who ultimately controls the financial interest or commodity

Clients with high net worth

Those with high net worth pose a greater financial risk

Clients involved in overly complex or unusual transactions

Clients with seemingly purposeless and questionable transactions pose a higher risk to organisational financial security

EDD for High Risk Locations

RFA can also quickly and easily identify potential clients or suppliers from high risk locations including:

- Countries on the FATF (Financial Action Task Force) greylist and blacklist

- High risk third countries

- Countries under sanctions or embargo

- Countries containing proscribed terrorist organisations

How It Works

Red Flag Alert’s enhanced due diligence process follows a simple process to create a fully compliant EDD check for high risk clients and suppliers:

1. Verify customers' identity using digital ID

2. Screen ID and information against PEPs and sanction lists

3. Identify which customers may require EDD

What is Enhanced Due Diligence?

Enhanced due diligence (EDD) is vital to protecting your organisation from financial crime (including money laundering and terrorist financing) when doing business with a high-risk customer. Discover how it differs from standard due diligence and why your organisation may need to perform it.

Live enhanced due diligence monitoring

PEPs, sanctions and adverse media checks form an essential part of any compliant anti-money laundering process.

But just because your client passes these checks doesn't mean that they won't become politically exposed or subject to a sanction or adverse media story during the course of your relationship.

So you can avoid harsh penalties and reputational damage should this happen, you need to know immediately. Red Flag Alert PEPS, sanctions and adverse media checks include live monitoring of domestic and international databases so you're never caught out

Request a Trial

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Knowledge Base

Topics covering Sales and Marketing, Risk Management, Data, AML and Compliance, and more

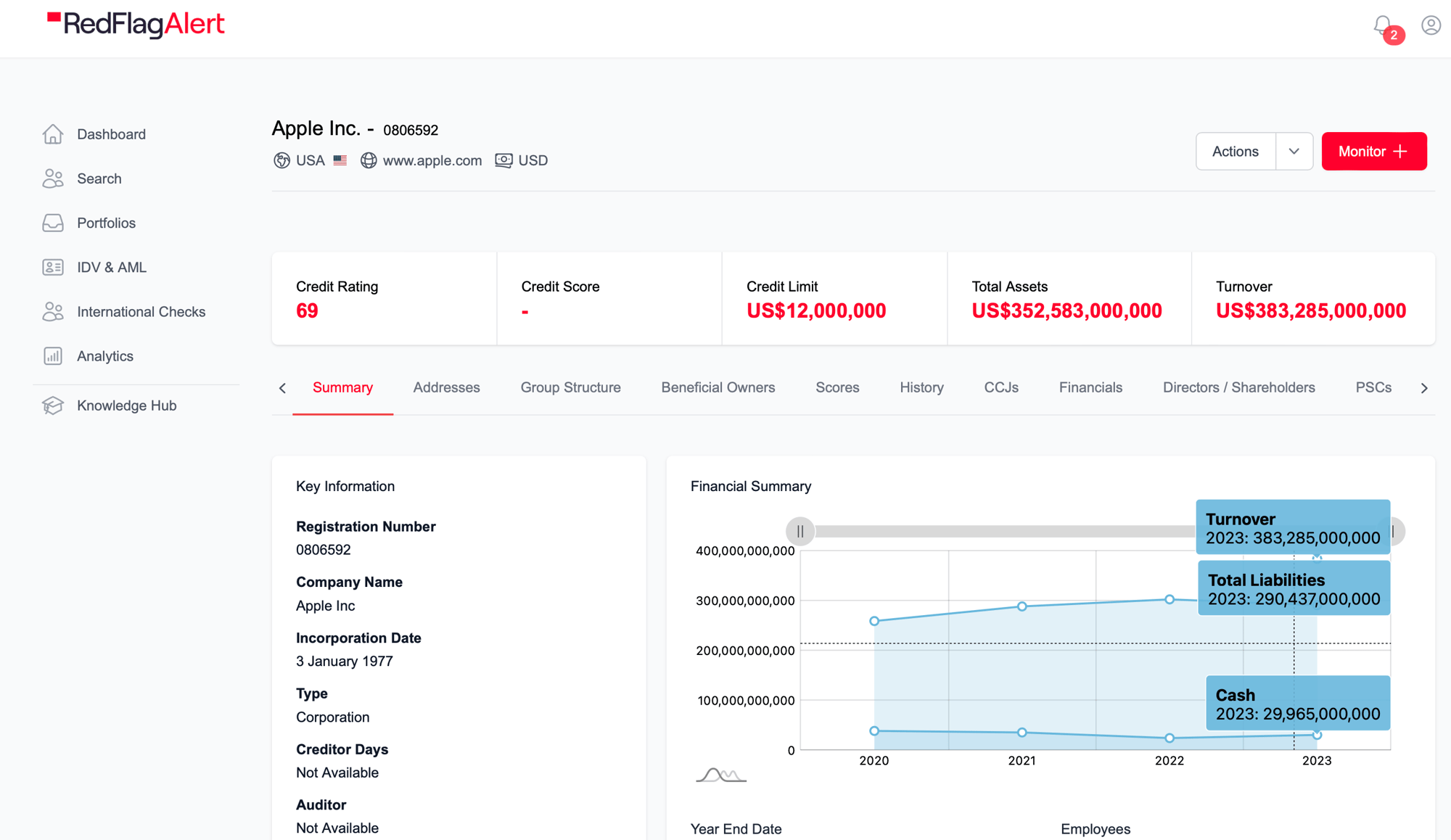

Free Company Report

Just looking for a Company Snapshot?

Enter a company name and click Free Report to see:

- Credit Rating

- Accounts

- Key Financials

- Key Contacts