Financial Health Ratings that Accurately Predict Insolvency

Every year around 15,000 UK businesses become insolvent. The average insolvent company leaves behind £205,000 in unpaid invoices.

If an insolvent customer owes you money you may never get it back. The resulting bad debt and loss of revenue can devastate your business.

But most business owners don’t know their customer is at risk until it’s too late.

Red Flag Alert’s financial health ratings protect your business by accurately predicting which customers are at risk of insolvency.

Integrations & Apps with Leading CRMs

PLUS many more

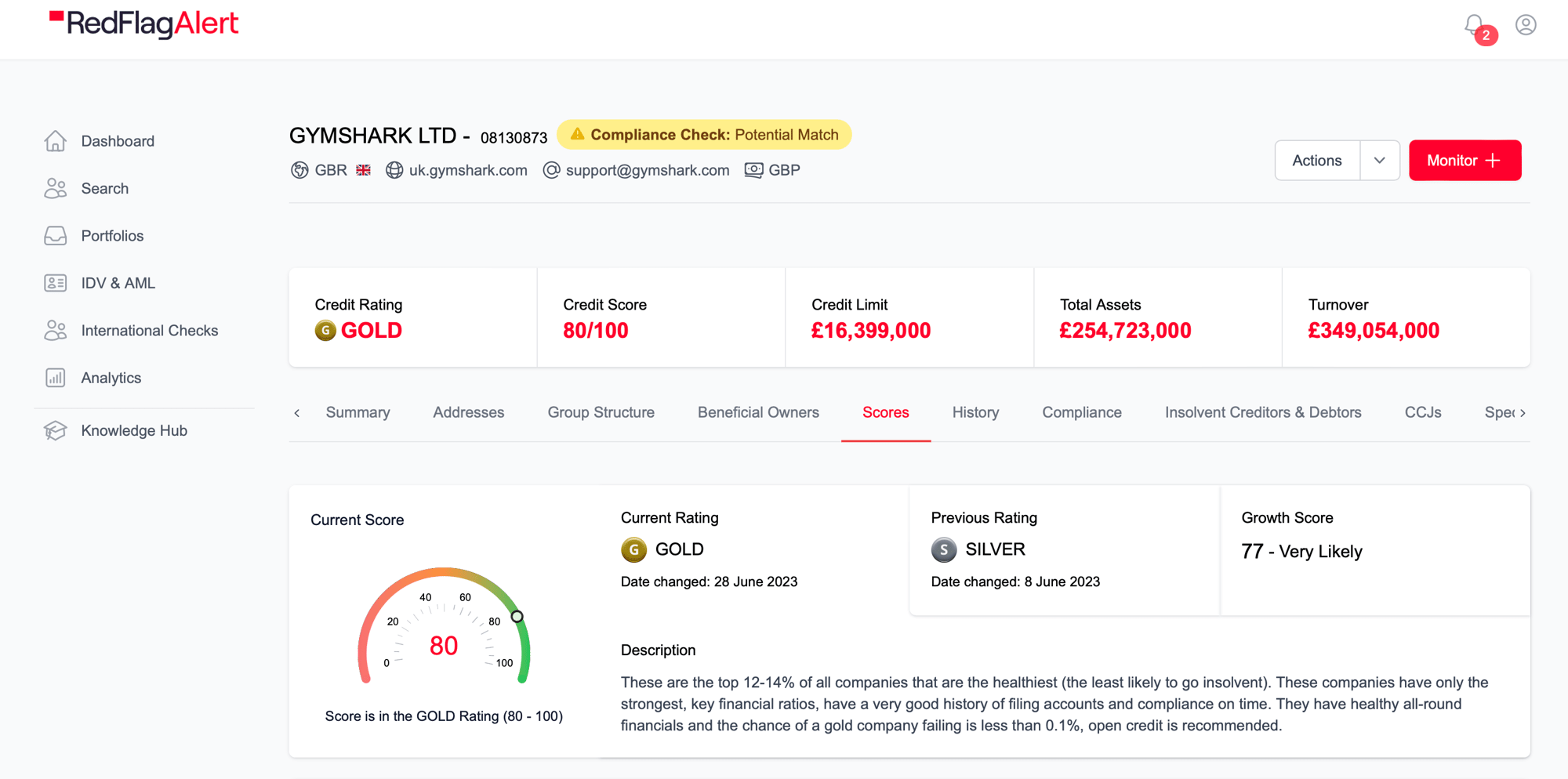

We assign every UK business a financial health rating that accurately predicts which ones are at risk of insolvency.

These predictions enable you to monitor the financial health of your current and prospective clients and suppliers. You can take proactive steps to protect your business should a customer’s risk level start to increase.

Free Company Report

Just looking for a Company Snapshot?

Enter a company name and click Free Report to see:

- Credit Rating

- Accounts

- Key Financials

- Key Contacts

How It Works

Our AI algorithm uses 20 years of business data to predict how changes in each company will affect its future financial health.

Why Red Flag Alert

Data on every UK company

Our database contains over 100 data points on every UK company.

Real-time data

Our data is updated in real time, giving you accurate risk predictions.

Broad range of sources

We draw data from more sources, so our scores are more reliable than our competitors’.

Monitoring alerts

Be informed as soon as something changes in your clients’ risk profiles.

Interactive Insolvency Chart

Free Tool - Insolvency Scorecard for UK Regions

Our scorecard provides a rating for each company, with gold, silver, bronze and amber for healthy businesses and one, two and three red flags for companies at risk of insolvency.

Select the below ratings to see how UK Regions fare:

Gold Rated Companies Explained

Gold Rated Companies Explained

A good history of filing compliance, with ideal levels of gearing, optimal liquidity, and favourable trends. Very low risk and open credit is recommended.

UK Regions with Gold Rated Companies:

| East of England | Northern Ireland | Wales |

|---|---|---|

| 178 | 37 | 86 |

| Scotland | Midlands | North East |

|---|---|---|

| 149 | 358 | 45 |

| North West | Yorkshire | South East |

|---|---|---|

| 249 | 168 | 506 |

| London | South West | |

|---|---|---|

| 548 | 214 |

Silver Rated Companies Explained

Silver Rated Companies Explained

Companies will be stable with healthy financials and a full history of filing compliance. Gearing and liquidity will be reasonable. Low risk and open credit is recommended.

UK Regions with Silver Rated Companies:

| East of England | Northern Ireland | Wales |

|---|---|---|

| 127 | 21 | 57 |

| Scotland | Midlands | North East |

|---|---|---|

| 90 | 244 | 36 |

| North West | Yorkshire | South East |

|---|---|---|

| 162 | 129 | 303 |

| London | South West | |

|---|---|---|

| 464 | 111 |

Bronze Rated Companies Explained

Bronze Rated Companies Explained

Companies may be new with no detrimental information, or where financial data is available, it may not be ideal. Fair trade risk and open credit is recommended.

UK Regions with Bronze Rated Companies:

| East of England | Northern Ireland | Wales |

|---|---|---|

| 554 | 126 | 275 |

| Scotland | Midlands | North East |

|---|---|---|

| 561 | 1314 | 174 |

| North West | Yorkshire | South East |

|---|---|---|

| 973 | 494 | 1414 |

| London | South West | |

|---|---|---|

| 3021 | 538 |

1 Red Flag Alert Rated Companies Explained

1 Red Flag Alert Rated Companies Explained

Companies are in the weakest 20% in their size category and display risk factors that might include a deteriorating financial position, sub-optimal gearing or liquidity, and the possible presence of recent or significant legal notices. The risk is elevated, and suppliers should seek suitable assurances or guarantees.

UK Regions with 1 Red Flag Alert Rated Companies:

| East of England | Northern Ireland | Wales |

|---|---|---|

| 247 | 48 | 126 |

| Scotland | Midlands | North East |

|---|---|---|

| 183 | 544 | 79 |

| North West | Yorkshire | South East |

|---|---|---|

| 436 | 221 | 650 |

| London | South West | |

|---|---|---|

| 1512 | 247 |

2 Red Flag Alert Rated Companies Explained

2 Red Flag Alert Rated Companies Explained

All the negative characteristics of a business with 1 red flag, plus additional significant risk factors, such as a county court judgement. Very high risk and guarantees advised.

UK Regions with 2 Red Flag Alert Rated Companies:

| East of England | Northern Ireland | Wales |

|---|---|---|

| 16 | 5 | 8 |

| Scotland | Midlands | North East |

|---|---|---|

| 10 | 36 | 6 |

| North West | Yorkshire | South East |

|---|---|---|

| 28 | 15 | 43 |

| London | South West | |

|---|---|---|

| 53 | 21 |

3 Red Flag Alerts Rated Companies Explained

3 Red Flag Alerts Rated Companies Explained

All the negative characteristics of a business with 2 red flags, but the situation is so dire that immediate insolvency is probable. 56% of companies with three red flags will cease to trade within seven days. Very high risk and guarantees advised.

UK Regions with 3 Red Flag Alert Rated Companies:

| East of England | Northern Ireland | Wales |

|---|---|---|

| 3 | 0 | 3 |

| Scotland | Midlands | North East |

|---|---|---|

| 1 | 14 | 2 |

| North West | Yorkshire | South East |

|---|---|---|

| 11 | 10 | 10 |

| London | South West | |

|---|---|---|

| 17 | 9 |

From Our Customers

Listen to how we have helped our customers

"We were looking for a partner to enhance the data offering to our clients, and Red Flag Alert have done just that. They understood our business, our culture, and our aspirations for the future. We’ve seen some great feedback on our integration, and we are very happy with both the solution and team at Red Flag Alert."

Rob Mead

Strategic Software Projects Director

"We use the search tool to identify businesses in specific geographic areas, with the right number of staff, the right turnover, and a low risk of non-payment. Now we have experienced the benefits of Red Flag Alert, we could not be without it."

Mark Bryan

NSL Telecoms

"From a business development perspective, our brokers are benefiting greatly from the additional information that Red Flag Alert supplies – we’re able to zero in on ideal prospects and build effective marketing lists."

Ben Robert-Shaw

Power Solutions UK

Effectively Predicting the Risk of Several Businesses

We often predict financial difficulties that our competitors and other traditional credit reference agencies miss. Here are some examples.

P&O

On 17 March 2022, P&O Ferries sacked 800 staff due to financial pressures.

One of our competitors rated the company 100/100 and recommended a £13 million credit limit right up until news of the sackings broke.

We predicted the troubles at P&O. We had rated the company one red flag since February 2022, and amber since December 2020. We recommended against extending credit.

PDR Construction

On 11 January 2022, Yorkshire-based PDR Construction LTD went into administration. The day before, several of our competitors recommended extending credit to the company. The highest limit was £470 million.

Shockingly, our competitors hadn’t changed their rating the day after the administration was announced.

We had rated the company one red flag since early January and recommended against extending credit to it.

Easy to understand insolvency risk scoring powered by the UK's number one insolvency score

Red Flag Alert are the UK leaders in insolvency risk scoring and maintain the most accurate insolvency score on the market.

We were created from the insolvency sector and have more than two decades of experience in being the consistently first to spot future insolvencies.

We also understand that for data to be effective it has to be understandable and actionable, which is why we developed our unique financial health ratings. These clearly tell you the strength of a company's finances and their risk of insolvency.

Our health rating make monitoring your prospects, debtors and suppliers simple as you are able to track their financial health in real time.

- The UK's number one insolvency score

- Over 20 years of experience in being the first to predict insolvency

- Unique financial health ratings make understanding company health easy

- 0-100 credit score

- Growth score

- Detailed and easy to understand reports on all UK companies

- Customisable monitoring tool

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at anytime. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, check out our Privacy Policy.

Knowledge Base

Topics covering Sales and Marketing, Risk Management, Data, AML and Compliance, and more