According to McKinsey, B2B businesses that use data-driven strategies are better able to identify and exploit the best growth opportunities.

As a result, these businesses achieve above-market growth and EBITDA increases of 15-25%.

B2B data can have a transformative impact on businesses' success. It allows them to take a holistic, unbiased view of where opportunities and threats lie.

This guide provides a comprehensive overview of what B2B data is, what it can be used for and what the future holds for it.

What is B2B Data?

B2B data is information on companies that is used for business purposes.

These purposes can include sales and marketing campaigns, credit checking businesses, monitoring the financial health of clients, checking an entity’s money laundering risk and more.

Many businesses collect and store their B2B data using a CRM. Others will pay to access an external B2B database.

Company data can be divided into two general categories: objective data and enriched data.

Objective data covers facts on the company’s current state of affairs. It includes information on:

- The company’s finances

- The people who own the company or have significant influence over it

- Any businesses that it might be in a group with, like subsidiaries and parent companies

- Contact lists and information

- How many people work at the business

- Where the company is based

Enriched data are calculations by third parties using objective data. This information is used to help people understand the company on a deeper level.

A good example is credit scores. These are calculated by credit referencing agencies using the company’s financial data. These scores help businesses understand whether their clients will pose a credit risk during their business relationship.

Other examples of enriched data include:

- Growth propensity

- Debt propensity

- Precise SIC codes

- Insolvency risk

Why using data should be important to your business

Using B2B data helps businesses make better decisions, giving them a decisive advantage over competitors.

In our latest Intelligence Report, we predict that around 26,000 UK businesses will become insolvent in the next 12-24 months.

If you want your business to avoid becoming another casualty of the post-pandemic recession you need to use every advantage available to you.

B2B data can help you find more customers that better fit your ideal customer profile, protect your business from financial loss and comply with industry regulations while keeping costs low.

You’ll be more resilient in difficult times and better-placed to take advantage of growth opportunities when they appear.

5 Important Things to Know about B2B Data

There’s a lot to know about business data. To use it correctly you need to understand the following points and how to identify red flags in your b2b data.

What Is the Difference between B2B and B2C Data?

B2B data is information on businesses and the people at those companies. As the name suggests, it is used by businesses to sell products and services that people buy in a professional capacity.

B2C data usually consists of information on people. B2C data is used to sell to people, but in a personal capacity.

B2B data tends to be more factual or based on mathematical projections. B2C data, on the other hand, is more focused on an individual’s personal preferences or emotions.

Other Types of B2B Data

B2B data isn’t just limited to information on the company itself. It also covers the people at the business.

This type of information is important for sales and marketing campaigns. After all, it’s important to know about the individual people you will be selling your products or solutions to.

Prospect data

This is information gathered during the prospecting phase, and it is used to decide whether an individual is the right person to target. It includes their job title, responsibilities and the department they work in.

Contact data

This is functional information used to get in touch with an individual. It includes their email, phone number and social media accounts.

Customer profile

This is information on the customer that helps you determine how to sell to them. It includes demographic factors like age, gender and education level, as well as psychographic factors like their personal motivations and level of risk aversion.

Try a Free Company Report.

What Is B2B Data Used For?

B2B data can be used throughout a business. Here are some examples:

- Find more and better clients

- Avoid losing money to clients that can’t pay invoices

- Credit check companies

- Avoid the loss of key suppliers

- Comply with regulations like GDPR and AML requirements

Help Sales Teams Find More and Better Customers

Most businesses want to increase their revenue, either by getting more or better customers.

The problem for many is that this process is slow. Their sales teams spend hours creating lists of prospects and then phone around to qualify them. Even then, there’s no guarantee that the prospect will convert or make a good customer.

B2B data makes the whole sales process more efficient. We explain how below.

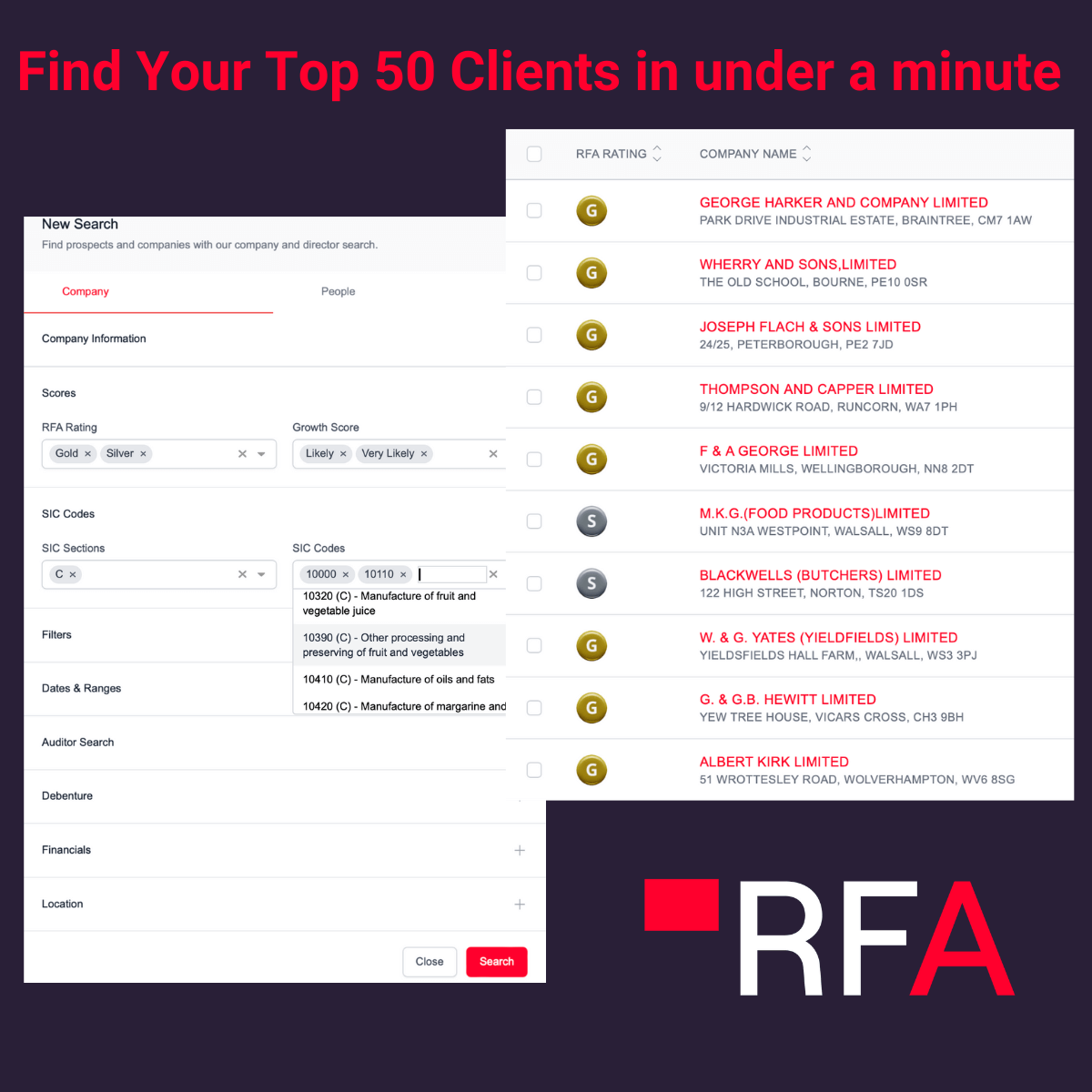

Find Your Ideal Customer

Ideal customer profiles are vital for finding businesses that best fit your products and services. However, creating them is often based on guesswork, resulting in vague, inaccurate descriptions. Sales and marketing teams can use accurate data to spot common characteristics among their best customers. This information can be used by your sales and marketing team to create detailed ideal customer profiles that allow them to precisely target the right businesses.

Generate Sales Lists

Once you know the type of company you want to target, you need to find businesses that match your profile. But this can be time consuming—you need to find businesses that could match the profile and then contact them to qualify that they do. With a B2B database, you can instantly bring up a list of businesses that match your criteria. This can be fed straight into your CRM, meaning that your sales team has constant access to fresh prospects.

Write Compelling Value Propositions

Successful salespeople are able to explain how their solution can help overcome a business’s challenges. But to find out which problems a business faces you need to gain the prospect’s trust and then extract the right information.

With business data you get some of this insight before you’ve even spoken to the customer. For instance, a regulatory fine is a clear indication that the company is struggling to manage some of its processes. If relevant, you could focus your proposal on how you help with this.

Contact Key Decision Makers

B2B data often includes contact details for key decision makers at a business. This means that you can speak directly to the right person, rather than wasting time speaking to gatekeepers.

Monitor for Opportunities

A large part of winning new sales is timing. If you are the first salesperson to get in touch with a prospect and the need for your service is relatively new then you are more likely to win their business. The question is, how can you know where and when to strike?

B2B data can help here too. It’s likely that certain changes in a company’s information will indicate that they need your services. For instance, if you provide restructuring and administration you’ll look out for businesses that are struggling to pay their invoices or have issued profit warnings. A good B2B provider will enable you to set sales triggers that alert you whenever this happens to a business.

Credit Check Businesses

Many businesses conduct company credit checks when onboarding a new client. This ensures that they will be able to pay their invoices during the course of the business relationship.

B2B data is used for this too. The credit referencing agency will provide a credit score for each company that is calculated based on a number of business data points. These could include:

- Any legal action taken against the business

- Whether business directors have fixed charges over assets

- Whether the business has experienced losses as an unsecured creditor

- Changes to accounting periods

- Liquidity

- Reserves

- Profit margins

The credit score gives you an indication of how much risk the business presents and how much credit you should consider extending to it.

Improve the Customer Experience

Credit control is often a customer experience pinch point. The customer is left waiting on the phone while the rep waits on a credit decision.

If the answer is no then they have wasted a lot of time. Good B2B data allows credit controllers to give instant decisions over the phone, improving the customer experience. Better still, they can build customer credit checks into the prospecting phase. This means your sales team only approaches financially sound clients and credit checks at onboarding become a formality.

Avoid Losing Money to Clients That Can’t Pay Invoices

When a customer’s financial position deteriorates it is bad news. They are likely to spend less money and be slower to pay their invoices—affecting your cash flow and revenue.

Even worse, if the customer becomes insolvent then that revenue is gone and you might even experience bad debt.

B2B data can help you spot insolvency warning signs and take preventative action to protect your business.

This kind of data is usually provided by the same businesses that offer credit checks. Essentially, you monitor many of the same points as you would during a credit check.

Monitoring Alerts

Monitoring alerts warn you if anything changes in a customer’s financial information. For instance, you can set them up to tell you if a customer loses control of its debt levels or if cash flow starts to take a hit. You can then choose what action to take.

Avoid the Loss of Key Suppliers

Losing a supplier can be more devastating than losing a customer. If a business that provides you with critical products or services becomes insolvent you may be unable to service any contracts. And if you are late or unable to deliver your services you might miss service-level agreements, resulting in clients not paying you or even taking you to court.

With B2B data you can monitor customer financial health. You can also use it to ensure your supply chain is robust.

Be GDPR Compliant and Meet AML Requirements

B2B data has a range of regulatory uses and can help businesses to comply with the law. Two great examples are GDPR and anti-money laundering (AML) requirements.

GDPR Compliant

Data protection laws like GDPR require businesses to hold the latest information and to be able to quickly retrieve it when requested.

This means that managing your own data can be onerous. However, B2B business databases like ours are sourced from reputable public domain records and are updated in real time.

This means you can immediately retrieve records and prove where you got them from.

Meet AML Requirements

B2B data usually includes information on the people who own a business. This makes it useful for conducting enhanced due diligence, know your customer and anti-money laundering checks to ensure that the people you work with are who they claim to be.

The type of business data that is useful for these kinds of checks includes:

- Ultimate beneficial owners (UBOs)

- Persons of significant control (PSCs)

- Corporate linkage

- Director histories

- Politically exposed persons (PEPs) and sanctions lists

How to Acquire B2B Data

There are two main ways to acquire B2B data: collect it yourself or pay providers.

Collecting it yourself requires no upfront cost, but it takes a lot of effort to gather, manage and maintain the data, and keep it up to date.

If the data is out of date or managed incorrectly you will not be able to rely on it to make decisions.

A better approach is to pay a business data provider. However, data changes all the time, so make sure that you get a real-time feed. This will ensure that your data is always up to date, allowing you to make reliable decisions. You also won’t have to worry so much about managing compliance, as your provider will help you with that.

How to Keep Your Data Up to Date

If you choose to manage your own data then keeping it current can be difficult. You can either rely on proactively checking the information you have to check that it is correct, or you can correct it as and when you discover that the information is wrong.

Both of these involve painstaking manual processes. As discussed above, a better approach is to get a provider that can offer a real-time data feed direct to your CRM. Red Flag Alert’s data can be integrated with a number of leading CRMs, or we can build a bespoke solution to ensure you have real-time, reliable data at your fingertips.

Benefits of Using B2B Data

Here are some of the benefits of using business data for the different user types:

Sales and Marketing Data

✔️Zero in on your ideal customer

✔️Kick-start your prospecting

✔️Shorten sales cycles

✔️Spot more opportunities faster

✔️Speak directly to key decision makers

✔️Increase revenue

Credit Control

✔️Minimise financial risk

✔️Improve your customer onboarding

✔️Make credit control more efficient

✔️Make reliable credit control decisions

Supply Chain Management

✔️Minimise supply gaps

✔️Work with financially sound suppliers

✔️Take proactive action to protect your supply chain

Financial Controllers

✔️Minimise financial risk

✔️Avoid bad debt

✔️Avoid cash flow issues

✔️Proactively manage customer risk

Compliance Officers

✔️Keep the cost of regulatory processes low

✔️Make customer onboarding more efficient

✔️Keep auditors happy

✔️Identify threats quickly and accurately

✔️Avoid reputational damage

✔️Avoid fines and prison

What to Look for in a B2B Data Provider

Finding a decent B2B data provider can be difficult. Here are a few things to look out for.

1. Real-time data

As mentioned above, a static database begins to deteriorate immediately. It eventually reaches the point where it’s useless.

Some providers claim to offer real-time data but actually update it in bulk once per month or week. This means that if a customer’s financial position deteriorates quickly you may not know until it is too late.

Make sure that your provider updates its data at least daily.

2. Sales Triggers

Assuming you’re using B2B data for sales and marketing teams, having triggers is a gamechanger. They provide you with a lead generation machine that gives your sales and marketing team a steady stream of red-hot sales leads.

3. Up-to-Date Algorithms

A good data provider uses algorithms that reflect today’s economy.

For instance, the retail, hospitality, leisure and construction industries have all been hit hard by the pandemic. If a business’s financial stability depends on one of these sectors they are likely to struggle in future.

However, many providers still use pre-pandemic financial health models, meaning that their predictions are unreliable.

4. Compliance with Data Protection Laws

As mentioned above, a key part of data protection laws like GDPR is being able to prove that your business data lists contain the latest information and have been acquired through legitimate data sources.

For instance, Red Flag Alert’s business information is sourced from publicly available databases and is updated in real time. You can stay compliant by connecting our API to your CRM.

How Much Does B2B Data Cost?

The cost of B2B data varies depending on the provider, what tools you require and how many records you want to access.

The best business databases charge up to £2.50 per record.

Business Data Trends

Improved AI Technologies

The remote working trend has made it easier for businesses to collect data. This will encourage the development of AI-based business data management technologies and services.

Our own machine learning algorithm that we use to enrich our data is a great example of this kind of system.

Growth in Account-Based Marketing

A HubSpot study found that 70% of marketing teams said that their use of account-based marketing had increased by 15% between 2020 and 2021.

According to a recent article from Strategic ABM it allows businesses to achieve:

- A 208% increase in revenue

- 171% increase in average contract value

- Improved win rates for 86% of marketers

ABM involves knowing as much about your target account as possible. To truly understand a company’s situation, you need a real-time business database like Red Flag Alert.

Third Party Cookies End

Google has announced it will end cookie tracking by the end of 2022. This is bad news for marketers as this kind of data helps them understand buyer intent.

Instead, there will be greater focus on first-party data. This is the consumer journey information collected when people interact with your channels.

81% of customers research a product online before buying—this kind of behaviour will provide ample intent data. It will be up to businesses to set up collection and analysis tools that can utilise this information effectively.

More Regulations

Governments are increasingly keen to enshrine the privacy and safety of people’s online data. That means further data protection regulation is inevitable. Mordor Intelligence says the governance market could see a CAGR of over 20% between 2021 and 2026.

Looking Forward: The Future of B2B Data

According to Avaus, incremental investments in your sales or marketing team’s headcount leads to incremental growth. But investment in data and automation leads to exponential growth.

They predict that within 5-10 years the way businesses use data and automation will decide the winners from the losers.

Although we agree with this premise, we also think that the timeline is too long—we believe that data is making a difference today.

To learn how Red Flag Alert’s B2B prospector tool can help your business grow, get started with a free trial.

Further Reading on B2B Data

Five Predictions on Data Changes to Future-Proof Your 2022

Data HQ’s Complete Guide to Data Quality

Insights to Impact: Creating and Sustaining Data-driven Commercial Growth

Data Governance Market - Growth, Trends, Covid-19 Impact, And Forecasts (2022 - 2027)

State of Marketing Trends Report 2022

The Ultimate Guide to B2B Marketing in 2022