Insolvency is a term almost all in the business world are familiar with but one that few understand the ramifications of. It is what all businesses work to avoid, so it makes sense that few people take the time to learn its processes. The following guide will work to explain the various forms and processes that corporate insolvency (commercial insolvency) can take.

A company is insolvent when it does not have sufficient assets to meet its commitments to its creditors.

Overwhelmingly, the only recourse is for the company to be liquidated and the capital raised to be distributed amongst its creditors. There are methods by which an insolvent company may be saved or if the problem is truly due to short term cash flow problems a liquidation may not be the appropriate action to take.

Whether your company is insolvent or is affected by the insolvency of a debtor company, it is a worrying time and you will want clarity on the insolvency process.

If a company is in an insolvent state the directors’ responsibility shifts from being towards its shareholders to its creditors. It is important that directors do not continue to willfully operate an insolvent company past the point where it is clear that it cannot be saved, as doing so can leave them open to personal liability to creditors and claims or even legal action can be made against them. This is because a company going insolvent will typically have a ripple effect, as its creditors struggle to absorb the bad debt and themselves enter into financial distress or even insolvency. This is especially true amongst unsecured creditors, as they rarely are able to recover much, if any, of the money owed to them. As such, directors of insolvent companies have an obligation to limit any potential damage their insolvency will cause to their creditors.

Liquidations are presided over by a licensed insolvency practitioner (or Official Receiver if there are no funds to pay an insolvency practitioner) and the directors of the insolvent company effectively lose control of the organisation. It is important to note that the responsibility of the liquidator is to the creditors and not the directors of the company. The liquidator will call in any debts owing to the company, sell off any assets and takes over any legal proceedings related to the company. They will also conduct a thorough investigation into the actions of the directors and staff of the company, if any illegal actions or malpractice are seen to have taken place they will be reported to the relevant legal or regulatory bodies. This can lead to disqualification of directors, fines or even jail time.

Insolvencies fall into two categories: voluntary insolvency, also known as a Creditors Voluntary Liquidation, and compulsory insolvency, also known as Compulsory Liquidation.

Creditors’ Voluntary Liquidation

This is where the Director/s of an insolvent company has reached the conclusion that they are unable to return the company to a solvent state and want to bring it to an end in a timely and, most importantly, legal manner.

Creditors’ Voluntary Liquidation is the most common form of insolvency in the UK and is a relatively straight forward legal process and is usually entered into under the guidance of an insolvency practitioner.

There are several advantages to a Creditors’ Voluntary Liquidation:

The directors can choose the time of the insolvency and the Insolvency Practitioner to start (and usually complete) proceedings. This is usually a highly stressful time and having control over how and when proceedings start can alleviate some of this.

Creditors Voluntary Liquidation does not go through the court system.

By starting insolvency proceedings promptly and voluntarily directors limit the risk of personal liability for debts or legal action against themselves.

As mentioned Creditors Voluntary Liquidations are a relatively straightforward legal process and follow clearly defined steps:

-

The directors will meet with an insolvency practitioner and decide on a Creditors Voluntary Liquidation.

-

A meeting of shareholders will be called for 14 days time, with the express purpose of voting on whether to continue with the insolvency. In most instances for smaller companies the directors will represent all shareholders; however, the process must still be followed.

-

At least 3 days prior to this meeting the insolvency practitioner must inform all creditors of the proposed action.

-

At the shareholders meeting a minimum of 75% of the vote must be in favour of the motion. At which point the insolvency practitioner will be appointed as liquidator and the directors will effectively lose control of the company.

-

The insolvency practitioner will inform Companies House of the insolvency and advertise it in the relevant Gazette.

-

The liquidator will call a Meeting of Creditors to explain the financial situation of the company and the events leading to the insolvency. Should 75% or more of the debt vote to appoint a different insolvency practitioner then a new one will be appointed.

-

rThe liquidator will conduct a thorough investigation into the financial dealings of the company and the directors must provide any pertinent information requested.

-

Assets will be liquidated and outstanding debt pursued and the recovered cash distributed to the creditors following the proscribed hierarchy of creditors.

-

Once there are no more funds to recover and proceedings come to a close there will be a final Meeting of Creditors, to vote on releasing the insolvency practitioner of their duties.

-

The company will be struck off the Companies House register and cease to be a legal entity. All outstanding debts will be written off.

Compulsory Liquidation

A compulsory liquidation is where a winding up petition has been successful and the courts order a company to cease all activity and appoint a liquidator. As soon as a compulsory liquidation is ordered directors lose all powers to run the company.

Compulsory Liquidations are less common than voluntary ones for several reasons: it is expensive to submit a winding up petition, most unsecured creditors will pursue other means of repayment and that it is best practice to voluntarily enter into liquidation if insolvent as it limits potential personal liability for directors.

However, some directors may believe they can return their company to a solvent state, try to conceal the insolvency or just cease trading once in an insolvent state and wait for a winding up petition to be submitted.

A creditor wishing to force a compulsory liquidation must submit a winding up petition to the courts. The process for a winding up petition is:

- A creditor must be owed more than £750 and the debt must be passed the terms of repayment

- They must have given the debtor at least 21 days to pay passed the agreed repayment date

- They may then submit a winding up petition to the courts

- This costs £302 in court fees and requires a £2,600 petition deposit. This may be reclaimed in the insolvency proceedings but is not likely to be

- If the debtor company’s paid up share capital is over £120,000 the winding up petition will be handled by the High Court; if not it will be the closest court to the debtor that handles insolvency

- The creditor will be given a copy of the petition

- This must be served to a director or employee of the debtor; or left on their premises if attempts to do this have failed

- A certificate of service must be submitted to the court

- A hearing date will be scheduled

- The creditor must advertise the winding up hearing at least 7 days before in the relevant Gazette

- The creditor must submit a copy of the advertisement and the relevant court form to the court 5 days before the hearing

- The hearing will take place and the winding up petition will be decided on. It is very rare that they are not granted

This is an expensive and time consuming process and as such is meant to be a last course of action. Whilst a winding up petition can be applied for any debt above £750 in reality they are usually reserved for higher sums. When a winding up petition is advertised in the Gazette any creditor of the company may attach themselves to it and it will proceed even if the original petitioner removes themselves from the petition.

Should a company feel they are solvent and wish to contest a winding up petition this can be done but can be difficult. The debtor must prove that they are solvent and can pay off not only the debt in question but all their debts. Should the payment in question be over a trade dispute, the reasoning for withholding payment must be given and the dispute must be shown to be legitimate on the behalf of the debtor. Even if a company can do this there are side effects of having a winding up petition advertised.

Banks will usually freeze the accounts of any business subject to a winding up petition. These can be unfrozen by obtaining a validation order from the courts but an extremely detailed level of evidence as to the company’s financial situation must be presented. Usually this will need to involve financial and legal professionals and as such is both timely and expensive. Being unable to make or receive payment for an extended period of time would put any company at risk but the effects on a struggling company that is barely solvent can be the act that consigns them to insolvency.

The reputational damage of a winding up petition being advertised can be huge. Suppliers are unlikely to offer credit and customers can scramble to find other suppliers. This will have a direct effect on the cash flow of the affected company and can push even a healthy company into insolvency.

Once a winding up petition has been passed through the courts and the ruling favours the petitioning creditor/s a winding up order will be issued and a compulsory liquidation will take place. At this point the company has been declared insolvent and the directors will lose control of it and no action can be brought against or proceeded with the company without leave of the court.

At this point an Official Receiver will be appointed, this is an officer of the court who can preside over the liquidation. Often with a compulsory liquidation, usually for micro-entities, there will be very few assets to liquidate which will not realise enough funds to pay an insolvency practitioner; and often not any of the creditors. In this case the Official Receiver will handle the entirety of the liquidation.

In cases where there are funds to appoint an insolvency practitioner usually one will be appointed as these are actively sought by insolvency practices. Financial institutions will usually have relationships with several insolvency practices and will usually want one to be appointed. As they are normally the main creditors of a company they are usually able to ensure one is appointed.

The Official Receiver may also apply to the Secretary of State to replace themselves with an insolvency practitioner should they feel it would be more appropriate for them to handle the liquidation. If so, the courts will appoint an insolvency practitioner to start proceedings.

The process of a compulsory liquidation, in cases where directors have run the company in an insolvent state for an extended period of time, may be more complex than a voluntary one but follows much the same process. Directors are legally required to furnish the liquidator with any information and documentation they request.

Within 12 weeks of the winding up order being issued the Official Receiver or insolvency practitioner will call the first meeting of creditors. There will be at least 14 days notice for this meeting.

At this meeting the liquidator will explain the reasons for the insolvency and present the current state of the business and its finances. Where an Official Receiver is liquidator any creditor can nominate an insolvency practitioner to take their place. Similarly, any creditor can request for the court appointed insolvency practitioner to be replaced with their choice. Both motions will pass with a vote of 75% of the debt.

Once the liquidator has been finalised the process of liquidation begins:

- The liquidator will conduct a thorough investigation into the financial dealings of the company and the directors must provide any pertinent information requested. This may be more complex and take longer than in a Creditors Voluntary Liquidation.

- Assets will be liquidated and outstanding debt pursued and the recovered cash distributed to the creditors following the proscribed hierarchy of creditors.

- Once there are no more funds to recover and proceedings come to a close there will be a final Meeting of Creditors, to vote on releasing the insolvency practitioner of their duties.

- The company will be struck off the Companies House register and cease to be a legal entity. All outstanding debts will be written off.

Role of the liquidator

The liquidator is an integral part of the insolvency process. They are responsible for realising the remaining assets of the company into cash. Whether the liquidation is voluntary or compulsory their responsibility is to the creditors not the directors of the insolvent company. They will also investigate the actions of the directors for malpractice or illegality, which can lead to professional disqualification or prosecution. Any documents or evidence they request of the insolvent directors must be provided.

Whilst the liquidator’s responsibility is to the creditors of the insolvent company they are not beholden to them as to how the liquidation proceeds and have final say as to how it does so.

A liquidator will:

- Collect, consider and confirm creditor claims

- Bring or defend any necessary legal actions relating to the insolvent company

- Hold meetings of creditors where appropriate

- Assess the value of and realise company assets

- Investigate the conduct of directors in the lead up to the insolvency

- Investigate company transactions in the lead up to the insolvency for fraudulent trading, undervalue transactions or preference to one creditor

- Distribute any realised funds to creditors, following the statutory hierarchy

Statutory hierarchy of distribution to creditors

Not all creditors are created equal and there is a legal framework as to who gets reimbursed first.

-

Fixed charge creditors – Creditors (usually financial institutions) who have secured a loan against a fixed asset of the company (eg. property)

-

Preferential creditors – These are usually HMRC and employees

-

Floating charge creditors – Creditors (usually financial institutions) who have secured a loan against an asset of a changing or shifting nature

-

Unsecured creditors – usually companies that have supplied goods or services on credit. Unsecured creditors are eligible for bad debt VAT relief

How to protect against bad debt and insolvency:

In reality, unsecured creditors rarely see any reimbursement from insolvency proceedings. This can cause a ripple effect of business distress and insolvency up the supply chain as they struggle to absorb the bad debt and fill the gap in revenue that losing a customer creates.

Not only do directors need to worry about clients entering insolvency but also their suppliers. Global disruption to supply chains and production of goods means that losing a key supplier may make it impossible obtain resources necessary to doing business or having to take on a new supplier at short notice with less favorable terms.

It is imperative that you have a clear understanding of the financial situation of all businesses that you have dealings with, both up and down the supply chain. Traditional credit software can base their ratings on out of date information and do not monitor for key warning signs of insolvency.

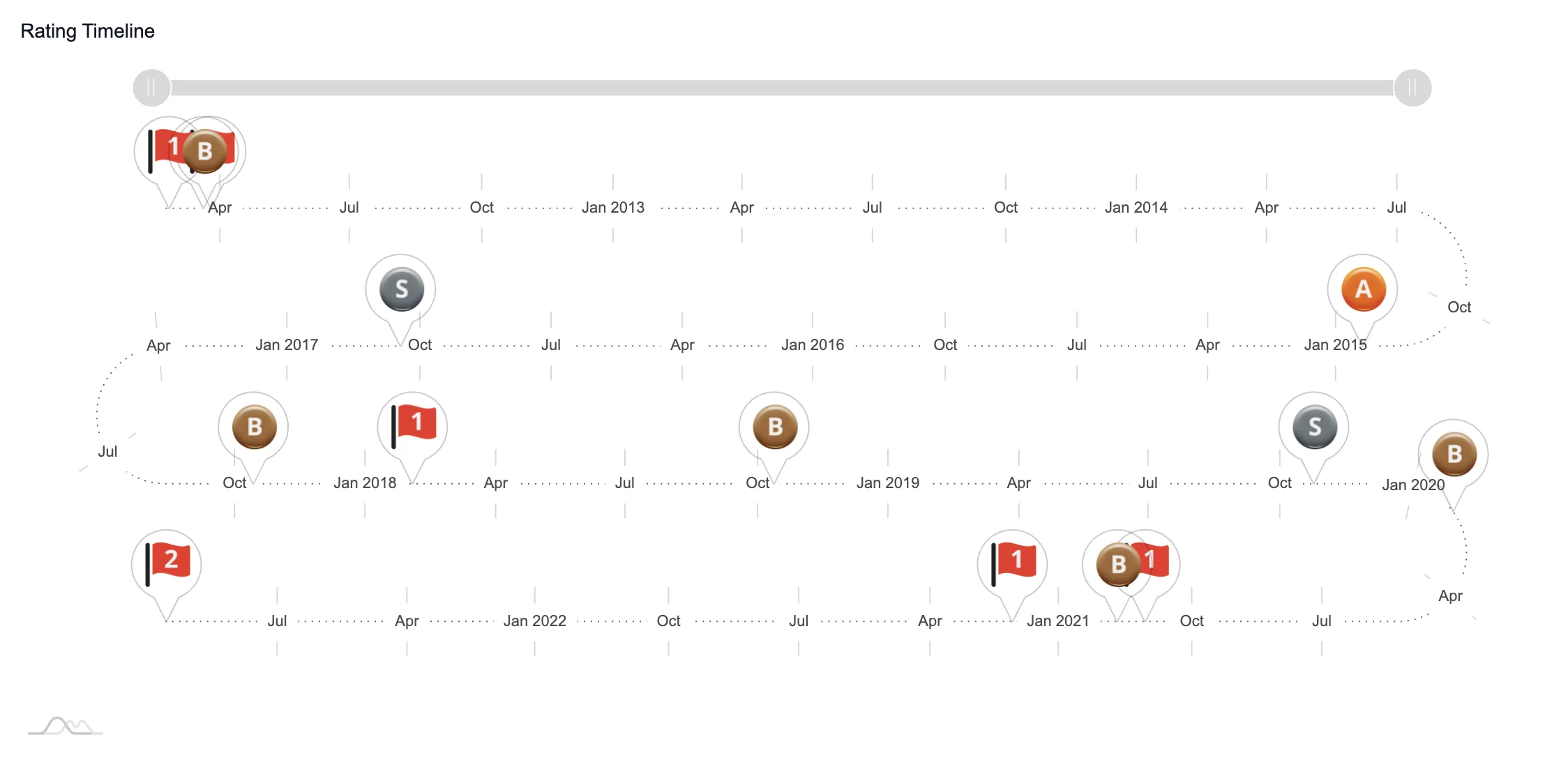

Red Flag Alert’s award winning software uses an innovative algorithm, based on over 15 years of insolvency data and developed with industry leaders, and the freshest data on the market to spot business distress at the first possible instance and provide that insight to you.

Our easy to understand scoring system and company reports give you an unparalleled insight into the financial health of every company in the UK. Allowing you to be confident in the deals that you make.

You are also able to create bespoke monitor lists and receive real time alerts on your business partners, prospective clients or even competitors. Giving yourself the best chance not just to protect yourself from bad debt and business disruption but also the ability to capitalise on any gaps in the market left by a faltering competitor.

Discover how Red Flag Alert’s experienced team can help you mitigate risk and protect your business. Why not get a free trial today and see how Red Flag Alert can help your business?