Losing a client to insolvency is always bad news.

The lost revenue can impact business projections, which can lead to staff cuts and loss of profits as well as curtailed growth.

But if you invoice your customers or extend credit to them then the threat is even greater.

If a customer enters insolvency and owes you money you are unlikely to get any of it back. Instead, your company will be forced to absorb the loss as bad debt.

Companies that experience this sort of loss are three times more likely to become insolvent themselves within 12 months than they would otherwise have been.

This is a common occurrence. Every week thousands of UK companies go insolvent, leaving a trail of bad debt worth billions of pounds each year.

Losing clients and taking on bad debt aren’t the only insolvency threats. Your business could also lose key suppliers.

You can avoid this devastating impact on your business by monitoring your clients’ financial health. This allows you to see if they are heading towards insolvency and take proactive action to protect your business. Additionally, there are 7 key signs that a company is on the brink of collapse which are important to note.

In this article we’re going to explain what warning signs to watch out for, how to test for insolvency and how Red Flag Alert can help.

What is an insolvent company?

An insolvent firm is unable to make debt payments or meet its financial obligations.

A business can also be technically insolvent if its level of debt is more than the value of its assets.

In the United Kingdom, insolvency is regulated by the UK Insolvency Act 1986, Section 123. You can read more about the Insolvency Act here.

Three tests to spot an insolvent company

There are two definitions of an insolvent company:

- It can no longer pay its bills when they are due

- The total cost of the company’s current liabilities outweigh the value of its assets

Both of these have their own test: the cash flow insolvency test and the balance sheet test, respectively. It’s important to conduct both tests, as they measure potential insolvency in different ways. Doing just one could miss important early warning signs of insolvency.

A third test is to use an insolvency scorecard like Red Flag Alert to accurately predict if a company will become insolvent.

Cash flow insolvency test

The cash flow test shows if a company has enough cash coming in to pay staff, suppliers and other bills, as well as buy stock and equipment.

Testing if a company is cash flow insolvent involves calculating whether it can pay its debt obligations when they are due. Asset sales and loans cannot be counted towards this.

If your customer needs to pay an invoice within 30 days, has no funds and won’t have any cash coming in before the period is up they are likely to be trading insolvently. There is a ‘reasonably near future’ rule which provides some flexibility with the cash flow insolvency test.

The balance sheet insolvency test

The balance sheet insolvency test determines whether a company’s assets are worth less than its liabilities. Company assets can include any buildings, vehicles or equipment that the business owns. To do the balance sheet test you should seek advice from a professional insolvency practitioner.

If a company’s liabilities are found to exceed its assets the business would not be able to cover creditor repayments if they were sold. In this situation, a company is described as having ‘negative net assets’.

If the value of a company’s assets and liabilities are similar then it could be an insolvency early warning sign. This means that a company can pose a risk even if they pass the balance sheet insolvency test.

A business can be balance sheet insolvent but cash flow solvent if its revenue allows it to meet its financial obligations.

Scorecard insolvency test

Insolvency scorecards like Red Flag Alert allow you to quickly and accurately assess how much risk a company poses.

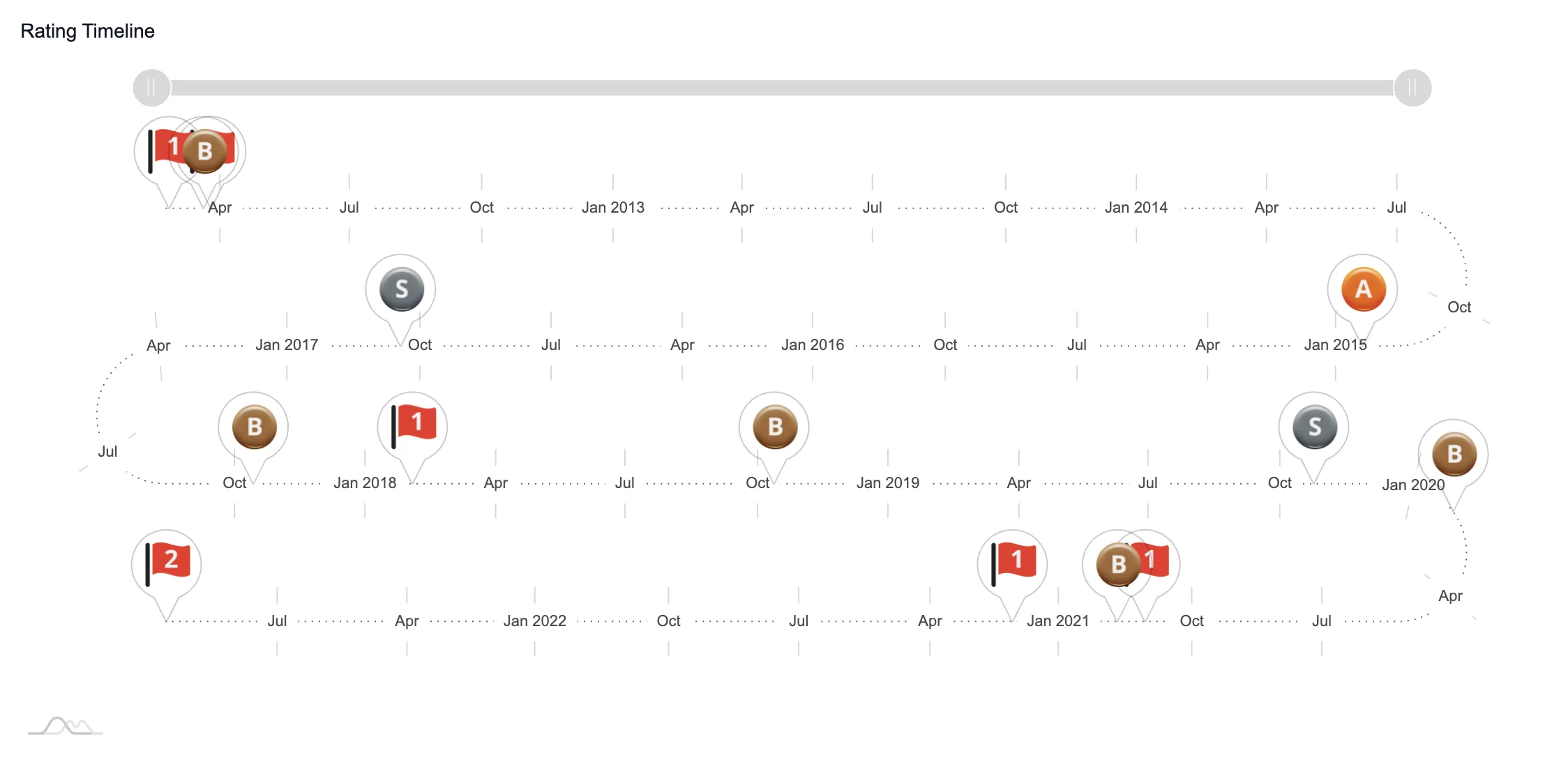

Our database consists of over 100 data points on every UK company. Our predictive algorithm uses 15 years of insolvency experience to spot trends and predict which companies will fail.

We rate healthy companies gold, sliver and bronze, while companies at risk of insolvency are rated one, two and three red flags.

This allows you to make decisions over whether to extend credit to a business or not.

8 warning signs of insolvent companies

It’s difficult to tell if your clients are at risk of insolvency. Some businesses will hide the fact from their suppliers as it could risk invoices being called in.

Others may not even be aware that they face insolvency. For example, they may just think that they have a short-term cash flow issue and not appreciate the repercussions of defaulting on their invoices.

It’s important to monitor your clients for the following insolvency warning signs:

Legal action

It is a bad sign when a company is being pursued to pay debts, either by you or other creditors via the courts. Watch out for companies that receive the following:

- Statutory demands for payment

- Winding up petitions

- County court judgements (CCJs)

These all indicate that a company is failing to fulfil its financial obligations and creditors are taking legal action to get their money back.

Companies that fail to meet a 21-day statutory demand for payment of £750 or more are considered to be insolvent. This figure was temporarily increased to £10,000 because of coronavirus. This period comes to an end on 31 March 2022.

Difficulties meeting financial obligations

Demands for payment are often the last resort for creditors. The early warning signs are usually obvious long before they are issued.

Watch out for companies that take an increasingly long time to meet their financial obligations. You may also find that the quality of their service dips and that they fall behind on their work due to financial pressure.

Fixed charges

If someone has a fixed charge over a business's assets, it means they get paid first in the event of company insolvency. Banks and other financial institutions often do this as security on a loan.

If a company’s owners hold a fixed charge over its assets this is a warning sign. If they are protected in the event of failure, then they may run the business differently—or even take risks.

A business where directors or shareholders have a charge over assets aren’t necessarily doomed to insolvency, but they are 2.8 times more likely to fail.

Suffering unsecured losses

If your customer is an unsecured creditor in an insolvency procedure, this can be devastating. Most trade creditors receive less than 10% of the money they’re owed. Any further losses will have to be absorbed by the company as bad debt.

Companies in this position are generally three times more likely to fail. The size of the debt needs to be placed into the context of the company. For example, a company with healthy cash flow and good liquidity will likely be able to weather a certain level of bad debt.

Changes to accounting periods

Overdue accounts or changes to filing periods are indicators that a company is in trouble. It could reflect poor management practices or cash flow issues.

Some companies also adjust their accounting date to try and mask financial difficulties. Multiple accounting period adjustments are a common feature amongst failed companies.

Poor liquidity

Poor liquidity can lead to a constant need to plug holes in cash flow, which is expensive, time consuming, and often fatal for a business.

What constitutes a good liquidity level will depend on the industry and the company’s current liabilities.

You need to ask yourself if you are confident that a business can weather cash flow difficulties such as a downturn in revenues.

Little or no reserves

Businesses of any size need to have a reserve pot. This is used to protect the company during periods of low consumer demand or challenging economic circumstances.

If a company has few assets and poor cash flow during these difficult periods it may have to delve into its reserves to survive. If it doesn’t have reserves it may have to turn to emergency borrowing, which will put it under further financial pressure.

If a company is already facing financial distress and has no reserves then it may be on the verge of insolvency.

Tight profit margins

Businesses working with tight margins often have little room to manoeuvre when facing financial difficulties.

These companies are exposed to sudden market changes. This could include a hike in expenses or a sudden loss of customers.

Even a change in interest rates could be enough to make them insolvent, as an increase in debt repayments may be unaffordable.

Spot insolvency early warning signs with Red Flag Alert

Red Flag Alert helps you identify whether your customers and suppliers are at risk of insolvency. This allows you to take proactive action to protect your business.

We provide detailed financial data on every business in the UK, including their balance sheet and any statutory demands or county court judgements (CCJs) that have been filed against them.

We also provide financial health scores. These scores indicate how likely it is that a business will enter insolvency in the next 12 months and explain whether you should extend credit to them or not.

Our data is updated in real-time, meaning you have accurate information and can make decisions with confidence.

You can make sure that you know if a company’s financial health changes at the earliest opportunity by setting up monitoring alerts.

Discover our complete guide to commercial insolvency

When your customers or suppliers go insolvent it puts your business at risk. Lost revenue and bad debt can have a devastating impact.

Find out how to avoid this happening to you by downloading our complete guide to commercial insolvency. In it, you’ll learn:

- The different types of insolvency

- Why understanding insolvency is important

- What to do if you have an insolvent client

- How to protect your business

You can discover more about how Red Flag Alert protects your business from insolvency risk. Why not Try Red Flag Alert today?