At Red Flag Alert we have always been proud of the accuracy of our ratings and our ability to predict business failure. As part of our commitment to this, we have regularly reviewed how we score our data and tweaked this to better fit in with contemporary economic trends and pressures. By doing so we have been able to be the first to predict such failures as P&O, Arcadia Group and Carillion.

It is not just the accuracy of our system that makes us different from our competitors, it’s our approach to data. We understand that the business operating environment and economy are not static things; they are constantly changing and what saw a company successful yesterday may see them fail tomorrow.

It is no secret that the past three years has seen an unprecedented paradigm change in both the national and international business markets. We have seen fundamental changes to the way companies operate and even how consumers behave.

As part of our commitment to provide our clients with the most accurate data available, and in light of the great changes recently seen, we have conducted a floor to ceiling review of our scoring system and reviewed our data records at a forensic level.

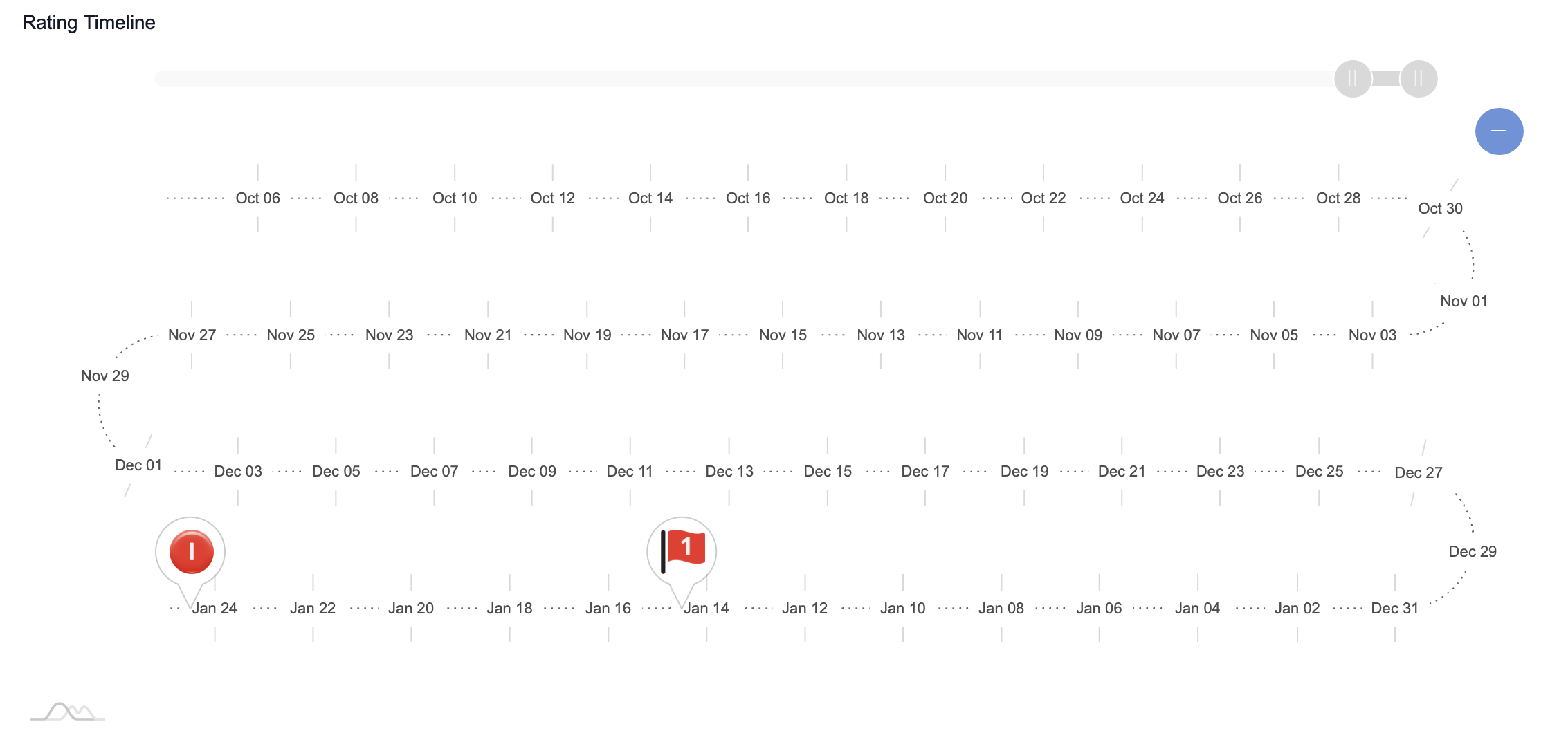

Image Above: Carillion PLC Insolvency Risk Scoring Timeline on Red Flag Alert Platform

We found that the post-pandemic economy sees distinctly different trends to before and that, whilst we were still able to accurately predict business risk, given these new trends it would be possible for us to create a new more accurate algorithm, better suited to this new world.

Our data scientists have been through the exhaustive process of analysing millions of records and billions of data points; comparing the post-COVID economy to pre-pandemic years. After months of analysis and consultation with industry leaders, they have created a new algorithm that is even more accurate than before.

Not only will this provide a more powerful tool for you but help us drive forward with our mission to innovate, adapt and, most importantly, provide more accurate data quicker to businesses.

When the new scoring system goes live in May, there will be some companies that will see a ratings change that more accurately represents their level of risk in the modern economy. If you have any questions during this time your Customer Success Manager will be happy to help.

To find out how our scorecard can help your business, click here for a free trial.

Already a client? Login here.