Getting a First Gazette notice for compulsory strike-off can be a worrying experience for business owners. A compulsory strike-off is one of the methods that can be used to forcibly shut down a company without the directors’ consent.

But, before this takes place, a notice of the intention to perform a compulsory strike-off will be posted in the publication. Should your company or a debtor receive one of these notices against them immediate action is required.

If you don’t take action quickly, your company could be struck off the Companies House Register and cease to exist legally.

Inexperienced business owners may find the situation even more confusing and stressful. That’s because they may not know what a compulsory strike-off is or understand its implications.

Brush up on your understanding of the publication and its notices to be one step ahead of compulsory strike-offs and the implications they have on companies.

Read on to hear from our team of experts, and discover how with Red Flag Alert, you can be the first to predict which companies will get struck off and mitigate the risk they bring.

First Gazette Notice

A First Gazette Notice provides at least three months' notice to the creditors of the intended action, if action is not taken, a second notice appears to advertise the company's dissolution.

The notice also states the company or its creditors have this period to oppose the motion or it will be struck off the register.

What does a Compulsory Strike Off mean for my company?

A compulsory strike-off is when Companies House forcibly dissolves a limited company or strikes off a company from its record without the directors of said company requesting this happen. At this point, the company will cease to be a legal entity. The organisation usually does this when a business fails to comply with its regulations.

These are outlined in the Companies Act 2006. There are other forms of company strike-offs too. Company directors can choose a voluntary strike-off if they no longer need their company, or third parties can petition to strike off a company. The most common ways that companies break regulations include failure to do one of the following on time:

- File company accounts

- Pay tax

- Pay late submission penalties

- Declare a new company address

Companies House will chase businesses that don’t comply with the regulations. If it still can’t get the information or payment, it will assume the business is no longer trading.

What is a First Gazette Notice?

A first Gazette notice is a public warning that Companies House will strike a company off its register. Before Companies House strikes off the company, they will post their intention in the relevant publication, depending on their location.

This notification is more for creditors and partners of the business as Companies House will already have issued communications to the company directors.

It publishes this in the Gazette, a public journal that advertises statutory notices. All insolvency proceedings must be advertised in it by law.

Notices give at least three months’ warning before Companies House strikes the business off.

Why does Companies House issue a first gazette notice for compulsory strike-off?

Companies House has to have legitimate grounds for seeking to forcibly strike-off a company and will only seek to do so in certain circumstances. These are:

- The company has failed to file its accounts

- The company failed to submit an annual confirmation statement

- The company has no appointed directors

- The company has not conformed to its legal requirements

- The company has ceased trading and is inactive

In any of the above cases, Companies House will attempt to contact the company directors (or persons of significant control if there are no listed directors) formally and in writing at least twice before posting a first gazette notice for compulsory strike-off. As such it is an action of last recourse.

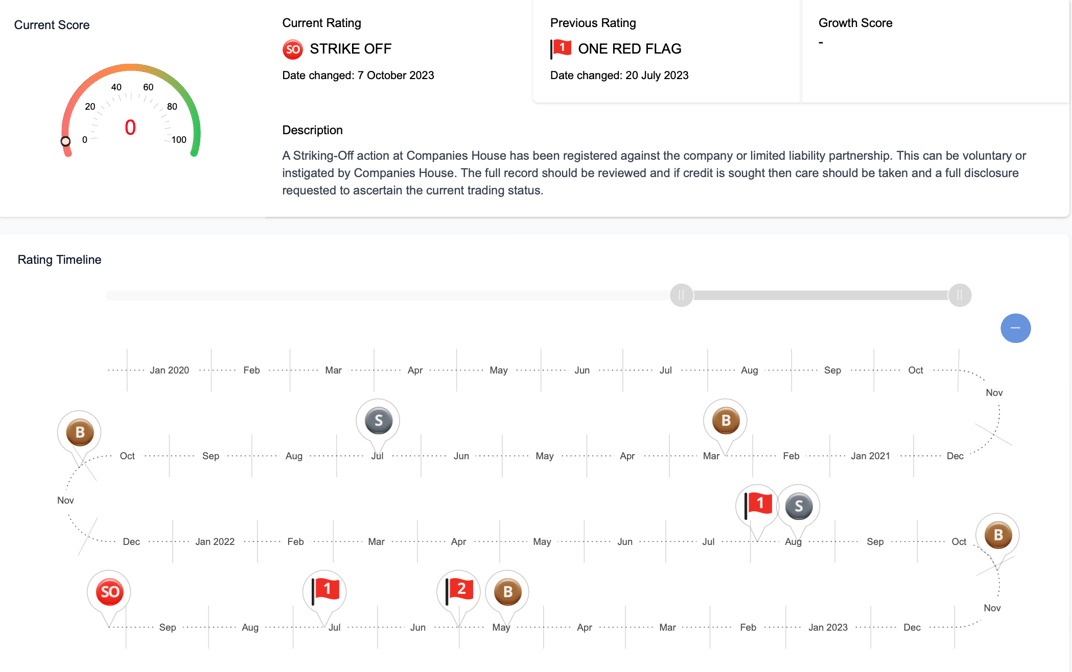

Above: A Look into a Compulsory Strike off on the Red Flag Alert Platform.

What are the effects of a First Gazette Notice for Compulsory Strike-off?

The primary intention of a notice is to alert the creditors of the company that they have two months to oppose the strike-off.

It is also intended to alert the company directors should they have missed Companies House’s communications.

The reason creditors must be informed is that once a company is struck off it ceases to be a legal entity and action to recover debts cannot be taken against it. In some cases, directors can be personally liable for debts, such as if it was in the initial contract terms or directors are found to have engaged in malpractice, but often unsecured creditors would be unable to recover the money they are owed.

Should a creditor wish to block the strike-off they can submit a challenge to Companies House evidencing the debt.

HMRC constantly monitor the gazettes for these notices and often block the motion if there are tax debts outstanding. As one of the UK’s largest creditors, they regularly do so.

Similarly, banks keep a close eye on the publications, as they tend to have high-value secured loans which they would be able to recover some of in an insolvency process. They also may freeze the accounts of any of their clients with a notice against them and it is a lengthy process for this to be reversed.

Should an operational company have its account frozen its ability to conduct business would be severely limited.

Any creditors that block the strike off may themselves submit a winding up petition believing that it is insolvent. This is much harder to reverse, has severe professional and reputational ramifications and, if successful, results in the compulsory liquidation of the company.

There is usually also reputational damage done by receiving a first gazette notice for compulsory strike-off as at the very least it speaks of poor filing practices within an organisation.

What are the Consequences for a Compulsory Strike off

A compulsory strike-off is bad for several reasons:

- Your bank will freeze your accounts while the compulsory strike-off application is active, making trading impossible.

- Being struck off the Companies House register reflects poor business management. This could damage your reputation.

- Customers could be alarmed and withdraw their business.

- If someone successfully challenges the application, company creditors may seek to recover their debts from you.

- When Companies House dissolves a business, its assets and cash become the property of the Crown.

If you want to retain these assets, you have to submit a successful objection to the strike-off. If Companies House upholds the objection to the strike, you can either continue trading or take the assets out of the business.

All employees will immediately be made redundant. They will be unable to claim redundancy pay, as the company has been dissolved with removal from the Companies House trading business list.

Objecting to a Dissolution Application

Anyone can object to the dissolution application. Directors can choose not to fight the motion and allow the company to be struck off or try to dispute Companies House’s decision.

If nobody challenges the application or the objection fails, the company is issued a second Gazette notice. This announces that the business has been struck off the Companies House register.

Companies that are struck off are removed from the register and cease to exist as a legal entity.

The company must stop trading and the company name is free for someone else to register.

Can You Appeal a Compulsory Strike Off?

To dispute this they will need to submit a suspension application directly to Companies House. They will also need to rectify the issue that led to Companies House seeking the strike-off. This generally involves submitting the required paperwork and/or proving they are still an active company.

Let’s say Companies House has issued you with a compulsory strike-off. What next?

There are three paths that you could take.

- You Want to Close Your Business

If you no longer need your company and you are happy for it to be closed down, you may not have to take any action. Simply allow the process to run its course.

In this situation, the strike off application could still be rejected by your creditors if you owe the money.

- You Want Your Business to Remain Active

On the other hand, you may want your company to continue trading. In this case, you will need to ask Companies House to cancel the strike-off using a suspension application.

You will usually have to correct whatever regulatory infringement you committed for the suspension application to be successful.

- A Third Party Wants to Keep the Company Active

A creditor that you owe money to could oppose a compulsory strike-off—for example, HMRC.

That’s because if Companies House dissolves your business they will be unable to recover the money it owes them.

This means that striking off your company isn’t a way to avoid paying creditors.

Suspending the Strike-Off Application

If you receive a first Gazette notice for compulsory strike-off and want to keep trading, you should take action fast.

If Companies House upholds an objection to strike off of the company, the company continues trading as per usual.

It’s crucial to find out why your business was petitioned with a company strike-off and take action to avoid it happening again.

Final Gazette Notice: Company Removed From Register Via Compulsory Strike-Off

Once three months has passed, and if there were no objections by the business owner or creditors, Companies House will dissolve the company and strike it from the register.

This will be published in the relevant publication as a final notice that the company has been removed from the register via compulsory strike-off. At this point, it ceases to be a legal entity and no action can be taken against it by a third party. Should an unsecured creditor have any outstanding debt, it will no longer be able to recover it.

Case Studies: Three Recent First Gazette Compulsory Strike Off Notices

Take a look at how the following cases demonstrate how compulsory strike-off notices are useful indicators of how companies are managed, specifically regarding mistakes or late submissions…

The National Theatre: The National Theatre was issued a first Gazette notice for compulsory strike-off due to an administrative error in its accounts.

According to an article in Third Sector, the organisation had referred to itself as ‘NT’ rather than the National Theatre. This minor infringement was enough for it to receive a notice.

The organisation successfully challenged this decision, however, the implications this process would have had on the National Theatre could have severely disrupted operations.

Monochrome Acquisition Limited (MAL): This company was set up by Dubai-based Bin Zayed Group (BZG) as a vehicle to buy Newcastle United Football Club.

An article in the Shields Gazette newspaper says that BZG was in talks with former Newcastle owner Mike Ashley to buy the company for £350m. The article suggests that the deal fell through.

MAL was issued with a first notice in November 2020, followed by a final notice in March 2021. It’s possible that the directors were happy for the company to wind up since it was no longer needed.

Child & Child: In 2020, Companies House issued legal firm Child & Child with a first notice for compulsory strike-off. The business had failed to submit its accounts in June.

According to an article in RollonFriday.com, the company’s COO said Companies House had issued the notice because Child & Child had filed its accounts late but claimed that it was not the company’s fault.

However, the business has been through a difficult period. It entered administration shortly after being named in the Panama Papers. The company was bought out by senior management and several company directors left during 2020.

The notice for compulsory strike-off suggests that the company is still facing difficulties.

What If my customers are Struck-Off?

If your customers are struck off the Companies House Register and still owe you money, you have a big problem.

When a limited company is dissolved, there is usually a long queue of creditors waiting to get paid.

Shareholders, employees, HMRC and secured creditors like banks will all be paid first.

Most or all of the money has usually gone by the time it gets to unsecured creditors like suppliers. Suppliers then have no choice but to write off these losses as bad debt.

The best way to avoid this is to proactively monitor your clients and customers and spot insolvency warning signs. This could include monitoring clients for insolvency risk.

A good example is if a limited company defers the date it intends to file its financial reports with Companies House. This is usually a sign that directors are poorly managing the business. Too many warning signs may indicate that a more severe infringement is likely in future—like failing to submit the report at all.

Get real-time monitoring software

Monitoring these factors across all clients is simply not possible for most businesses. That’s where Red Flag Alert comes in.

We act as an early warning system by giving every UK business a financial health rating.

Healthy companies are rated bronze, silver and gold. Businesses likely to go insolvent in the next 12 months are rated one, two and three red flags.

This allows you to spot which companies could default on their invoices and take preventative action to avoid this.

A company director can also use Red Flag Alert to find out the health of their own business. If their company gets a poor rating, they can take steps to improve their processes, liquidity, and cash flow. This stops problems from snowballing into more significant issues down the line.

Our risk management features include:

- Highly accurate predictions based on 142 data points for every company

- Users can set alerts that notify them as soon as their customers’ financial position changes.

- We update our data in real time using ten leading sources.

- Over 180,000 changes are made to our data every day.

We offer in-depth intelligence on every UK business. Companies can use this for other purposes, including lead generation and anti-money laundering checks.

If you are worried about the financial health of one of your customers and want to see how Red Flag Alert’s company credit checking solution can help, try Red Flag Alert today. For immediate insights, take a look at our Big Bang Data report.